- Unreported crypto profits can face up to 70% penalties, and the government can check past earnings from the last four years.

- Platforms like Binance and Bybit are already under pressure, and all crypto transactions must be reported to avoid fines.

- Traders need to report their income properly, as the government is strictly enforcing tax laws.

India’s New Crypto Tax Rules Bring Heavy Penalties

India has begun strict new tax guidelines on the profits obtained from cryptocurrencies. Undisclosed gains will attract up to 70% penalties.

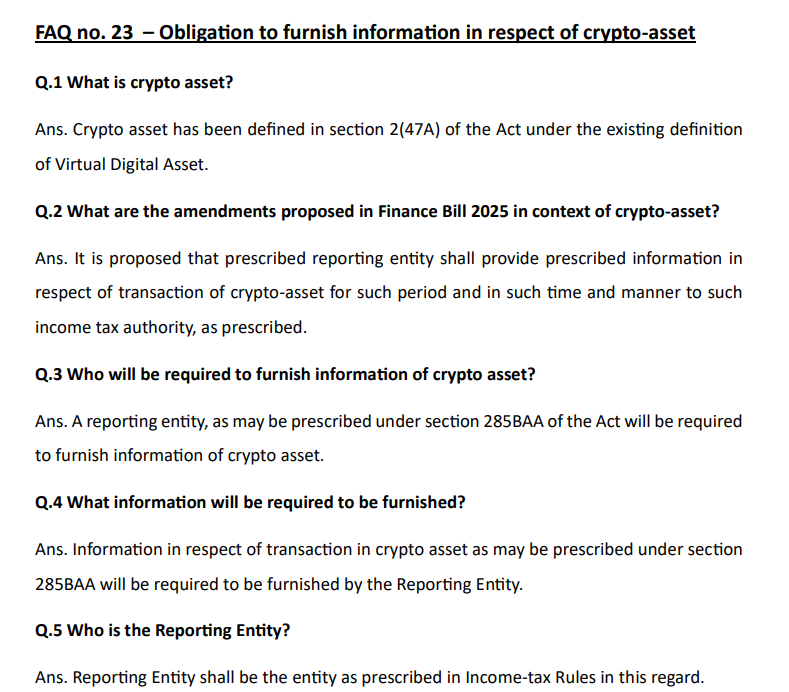

This amendment is under Section 158B of the Income Tax Act as announced by Finance Minister Nirmala Sitharaman in the Union Budget 2025. According to it, crypto will be tagged as Virtual Digital Assets (VDAs). And its taxation will be absolutely like that of cash, gold, and jewelry.

Any unreported crypto gains from up to four years ago can be subject to block assessments, meaning that the authorities can review and tax past earnings. Also, the crypto exchanges and financial institutions are supposed to report all transactions to the government for compliance.

The Indian government has been increasing its scrutiny on crypto tax evasion. Authorities found nearly $97 million in unpaid Goods and Services Tax (GST) linked to crypto exchanges, with Binance and Bybit already facing regulatory pressure. Bybit even suspended its services in India on January 10. This crackdown follows a global trend of stricter crypto taxation, with the U.S. Internal Revenue Service (IRS) also introducing tougher reporting rules starting in 2025. The IRS’s move has faced backlash, with some crypto groups suing the agency over claims that the regulations are unconstitutional.

Unreported Profits May Lead to Heavy Fines

The country is tightening the noose around its crypto taxes to keep a better grip on the market. In 2022, the government had already welcomed a 30% tax on the profits made by cryptocurrencies and a 1% TDS on every transaction. With the new rule, the tax authorities will be empowered to get hold of many unreported earnings. And penalize those who are non-compliant. Crypto investors might need a re-orientation of their approach to ensure they are compliant.

This, of course, would mean traders and investors being much more cautious about reporting their crypto income. And lest they end up paying the full brunt of the government for not declaring profits. After all, the government is quite serious about these tax laws. With this development, India further intensifies its crypto regulation drive, making it crucial for investors to be in the know and act accordingly.

Highlighted Crypto News Today

The Importance of Intellectual Property (IP) in Web3: Spotlight on $KIKICat Coin