- India’s DGGI has demanded ₹722 crore ($86M) from Binance for failing to comply with GST regulations.

- Binance is charged with collecting ₹4,000 crore ($476M) in trading fees from Indian users without GST registration.

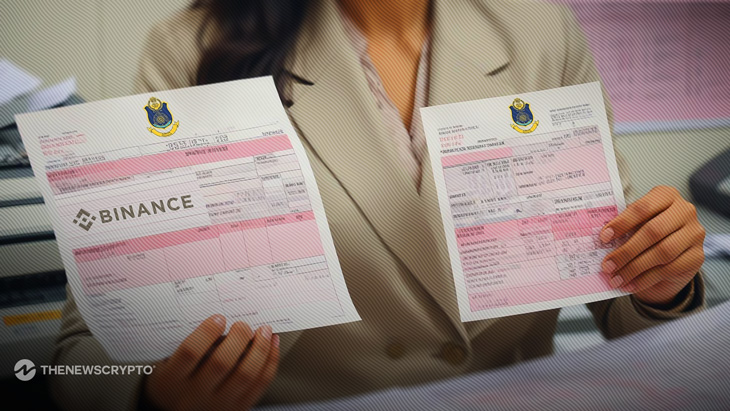

India’s Directorate General of Goods and Services Tax Intelligence (DGGI) has issued a show cause notice to Binance, one of the world’s largest cryptocurrency exchanges. The notice demands a payment of ₹722 crore ($86 million) in Goods and Services Tax (GST), marking a pivotal move in the regulation of the burgeoning crypto sector in India.

📢Indian Directorate General of GST Intelligence (DGGI) imposes @binance with GST fees of $86.01M❗️

— TheNewsCrypto (@The_NewsCrypto) August 6, 2024

The Ahmedabad DGGI issued a show-cause notice stating the fees worth 722 crore in INR. 🇮🇳

📌This is the first time the regulatory body has approached a #crypto firm. pic.twitter.com/HXF4qhWqX3

The notice alleges that Binance earned approximately ₹4,000 crore ($476 million) in trading fees from Indian users without sticking to the Indian GST registration requirements. The DGGI’s notice to Binance is the first tax demand imposed by the Indian government on cryptocurrency firms.

Despite its significant international presence and operations across over 150 countries, Binance had not registered under India’s GST framework. To address this issue, the DGGI reached out to Binance’s associated companies in the Seychelles, the Cayman Islands, and Switzerland. But they did not receive any response. Later, Binance appointed a local legal representative in India to collaborate with the DGGI and resolve the tax compliance issue.

Binance’s Compliance Struggles and Regulatory Actions in India

Binance, which operates on a global scale and holds a significant market share, was banned in India earlier this year due to non-compliance with local regulations. However, in April, the company announced its plan to resume operations in India, provided it met its outstanding tax obligations.

In May, Binance obtained approval from India’s Financial Intelligence Unit (FIU) to operate as a virtual asset service provider (VASP). Nonetheless, it faced a ₹18 crore ($2 million) fine from the FIU last month for failing in anti-money laundering compliance.

The DGGI’s actions are part of a broader crackdown on cryptocurrency exchanges, with expectations that other international and domestic platforms will also come under scrutiny. Meanwhile, India’s financial regulators, including the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), are working to establish a more comprehensive regulatory framework for cryptocurrencies.

Meanwhile, the Indian crypto community is grappling with a crisis following a significant security breach at WazirX, a leading exchange. The July 18 attack resulted in the theft of $230 million worth of assets from a multi-signature wallet. The inadequate recovery efforts by WazirX and the government’s limited involvement have intensified concerns within the sector.

Highlighted Crypto News Today