- HYPE gained nearly 6% today, but overall 55% down from its previous ATH, keeping it within a bearish channel.

- The HYPE tokens unlock worth $326M is scheduled on Jan 6, poses near-term supply risk

Hyperliquid gained around 5.92% to $26.52 as broader crypto markets improved. Despite the increase, the token remains significantly lower, down almost 55% from its September top of $59.39. With that, the daily trading volume has also increased roughly 84% to $242 million.

Then, Coinglass derivatives data show futures trade surges 42% to $1.21 billion, while open interest positions increased 3.51% to $1.44 billion. This increased daily trading, futures trade and open interest, signals a continuous investor engagement around the HYPE altcoin without a clear directional move.

12.46M HYPE Token Unlock Approaches

As per the tokenomist data, 12.46 million HYPE tokens will be unlocked, worth about $327 million, accounting for 3.61% of the supply. While token unlocks often trigger short-term selling. For HYPE, which is already facing a price slump, this adding supply is a major hurdle, which could make it difficult for the token to gain any real upward momentum.

HYPE Price Analysis

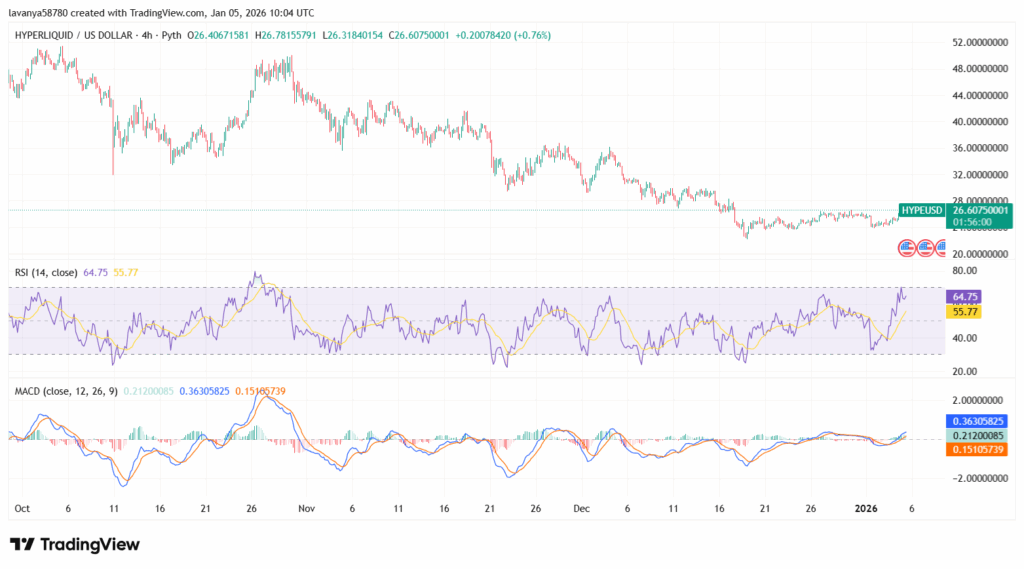

From a technical point of view, HYPE is attempting to stabilize on the 4-hour chart after an extended downtrend, with price consolidating around the $25–26 zone. With that, RSI is moving above 60s, signaling growing buyer interest without entering overbought territory. Also, the MACD shows positive crossover, these indicators point towards a relief rally.

However, if HYPE breaks above the key $29 – $30 range to confirm an upside rally and it needs to maintain the $25 support zone through the unlock event to maintain stability; losing it could cause a downside trend.

Highlighted Crypto News Today:

Visa-Issued Crypto Card Spending Soars 525% in 2025, Led by EtherFi