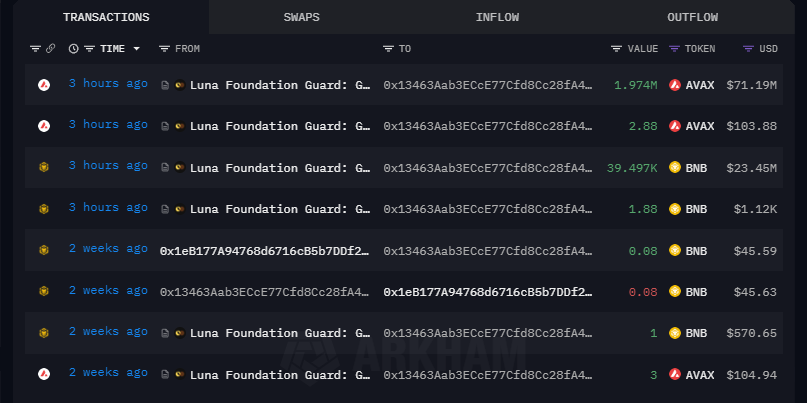

- Luna Foundation Guard transferred millions worth of AVAX and BNB tokens to an unknown wallet.

- The fund plans to boost the security transition of multi-sig wallets.

The Luna Foundation Guard (LFG) address had a fund transfer of a substantial amount of digital assets. Around 1.974 million AVAX, approximately worth $71.2 million, and 39,499 BNB worth $23.5 million, were moved to an unknown address. Additionally, an insignificant amount of transfers were also recorded on the platform, as per Arkham Intelligence.

LFG is dedicated to economic sovereignty, security, and open-source software that helps build a truly decentralized economy. Two days ago, they announced the transfer details and their plans to boost the security transition of its funds from multi-signature (multi-sig) wallets to a direct custody solution. This strategic initiative is set to take place in the coming days. Furthermore, to maintain transparency and traceability, LFG funds will remain trackable on the LFG Reserves dashboard.

Adopting the direct custody approach points to mitigating risks associated with the management of the assets, providing greater security for their funds. This underscores LFG’s dedicated stance in addressing security concerns and re-establishes its commitment to safeguard the financial infrastructure.

The LSG Crash

Luna Foundation Guard, the firm behind Terra, has been mounding Bitcoin in reserve for emergency purposes. The goal of Do Kwon, Co-founder of Terraform Labs, was to accumulate $10 billion BTC to back the UST, (TerraUSD) the decentralized and algorithmic stablecoin of the Terra blockchain.

The value of algorithmic stablecoins is pegged to a dollar at $1. But what makes them unique is their peg being backed by a volatile crypto asset. UST maintained its value to the $1 peg and was backed by LUNA, its sister coin. To mint 1 UST, users had to burn $1 worth of LUNA, and to recover 1 LUNA, it required 1 UST to burn.

Do Kwon had a tentative settlement with the U.S. Securities and Exchange Commission (SEC) which sued for allegedly misleading crypto investors before the collapse of TerraUSD about its stability. The regulator also accused them of deceitfully claiming Terraform’s blockchain was used in a popular Korean mobile payment app. The SEC sought penalties totaling millions of dollars, and a ban on managing the crypto asset securities for both Do Kwon and Terraform Labs.

Highlighted News of the Day