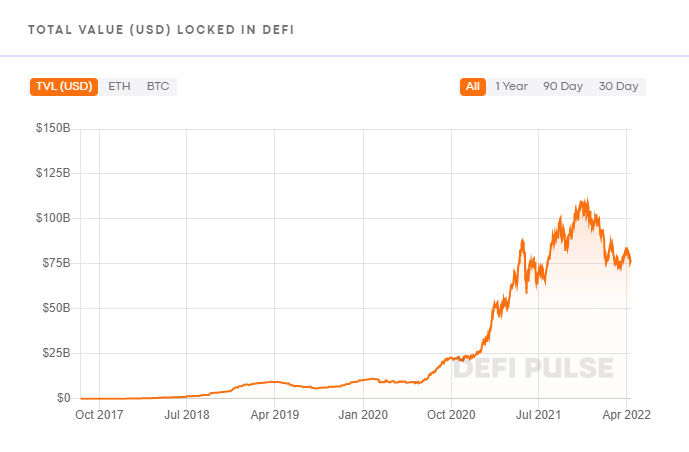

The decentralized finance ecosystem, popular as DeFi, has experienced magnanimous growth over the past three years, growing into a $100 billion market. The ecosystem is still relatively new in the growing crypto market but offers its users vast opportunities to earn income, connect to the financial system, and profit from simple protocols built on blockchain. Most of the DeFi projects run on Ethereum, or Ethereum-based solutions, sharing similar architectures, whereby decentralized applications (dApps) run on virtual machines on a blockchain.

Growth of the DeFi sector since 2017 (Image: DeFi Pulse)

Nonetheless, the future for the DeFi ecosystem remains bleak as there’s no telling whether the leading projects in the space can last long or whether they’ll be as beneficial and profitable as more users sign up and the platforms are more scalable. One of the most common solutions to ensure the DeFi ecosystem remains sustainable in the future is to move away from the dependence on Ethereum.

As one expert put it,

“To secure a sustainable future for DeFi, we need to look beyond Ethereum.”

The mechanics of the SAFUU model

To this end, developers are grinding out DeFi solutions by the day to make the ecosystem more sustainable and scalable in the long term. One such project, SAFUU (Sustainable Asset Fund for Universal Users) is designed from scratch, introducing innovative concepts that ensure the platform will run long into the future and remain profitable even as it scales.

Safuu is a unique DeFi project, launched by founder and CEO Bryan Legend, which integrates auto-staking and auto-compounding through rebasing. A rebase (or price-elastic) token is designed in a way that the circulating token supply adjusts (increases or decreases) automatically according to a token’s price fluctuations. Safuu’s sustainable rebasing mechanism not only delivers the highest APY in the market at present but also takes into account ways to remain profitable even as it scales up.

Safuu provides a decentralized financial asset protocol that rewards users with a sustainable fixed compound interest model via its unique SAP protocol. The platform currently boasts as one of the highest yielding DeFi protocols in the space with over 300,000% APY for stakers. The APY is paid after every rebase (15 min), and users only need to buy and hold $SAFUU tokens in their crypto wallets.

Making the future of DeFi sustainable and stable

One of the most prominent features of Safuu is its sustainability factor, which stems from the genius smart contract and unique proprietary mechanisms on the platform. Key to maintaining sustainability despite the high APR is Safuu’s Fire Pit, which is a buyback-and-burn contract that reduces the circulating supply of $SAFUU tokens. According to the company’s website, 2.5% of all $SAFUU traded are burnt in the Fire Pit. This means the more tokens that are traded, the more are permanently removed from circulation. This grows the Fire Pit through the self-fulfilling Auto-Compounding feature, reducing the circulating supply and keeping the Safuu protocol stable.

Secondly, the DeFi protocol also includes the Safuu Insurance Fund (SIF), which serves as an insurance fund to achieve price stability and long-term sustainability by maintaining a consistent 0.02355% rebase rate paid to all $SAFUU token holders. Additionally, 5% of the total trading fees are stored in the insurance fund, which helps sustain and back the staking rewards provided by the positive rebase. The SIF prevents flash crashes of the $SAFUU token by maintaining price stability and greatly minimizes the downside risks of DeFi. The Treasury provides support to the SIF in the event of an extreme price drop in the $SAFUU token. The Treasury also funds investments, new Safuu projects and marketing for Safuu.

The tokenomics of the protocol ensures the protocol remains stable, scalable, and profitable as more users join. Safuu’s token supply is only 325,000 $SAFUU, with an auto burn rate of 2.5%, auto staking and liquidity provision (LP) every 48 hours and the factor of rebasing at 15min intervals provides a more linear progression of sustainability. Simply, the more that is traded on a daily basis, the bigger the Treasury & SIF balance grows automatically to aid with long-term sustainability and future growth.

Finally, Safuu also includes a unique and proprietary Safuu Auto-Liquidity Engine (SALE) which automatically injects an additional 4% liquidity every 48 hours automatically to maintain protocol stability and to make sure the APY is upheld for the entire life of Safuu. The SALE also adds more and more liquidity to the pool which will allow $SAFUU token holders to easily sell their tokens at any time with little to no market slippage.