- Tom Lee has backed the Q4 rally for BTC price and ETH price.

- Fundstrat Co-Founder has based this on the recent 25 bps rate cut by the US Federal Reserve.

- Short-term estimates for BTC price and ETH price are bullish.

Fundstrat Co-Founder Tom Lee has stated that there is a possibility of rally for ETH price in Q4. He has backed this by mentioning the recent rate cut by the US Federal Reserve as one of the reasons. Lee also believes that the fourth quarter could simultaneously see a BTC price rally. ETH price and BTC price are anticipated to surge after the conclusion of the ongoing price correction.

Tom Lee Backs ETH Price Q4 Rally

Tom Lee, Co-Founder of Fundstrat, has reportedly stated that the ETH price could surge in the fourth quarter. Lee has said that a surge in ETH price would be backed by the recent 25 bps rate cut by the US Federal Reserve. He has not specified the milestone, but it is estimated that ETH price could breach the mark of $5k in the days to come.

Tom Lee has also pointed out that ETH price rally would happen due to the rising adoption among global central banks. ETH price, at the moment, is down by 0.80% over the last 24 hours. The Ethereum token is being traded at $4,542.40 with a decline of 36.21% in the 24-hour trading volume.

ETH price last banked an ATH of $4,953.73 on August 25, 2025. It continues to be second across global cryptocurrencies with a market cap of $548.28 billion.

BTC Price is Also on the List

Tom Lee has also backed the rally for BTC price in Q4. He has emphasized that the recent slashing of the lending rate and upcoming probable rate cuts are likely to boost the price of the flagship cryptocurrency. The Fed rate cut, he added, would boost confidence among businesses. It would also be beneficial for housing and non-cash assets.

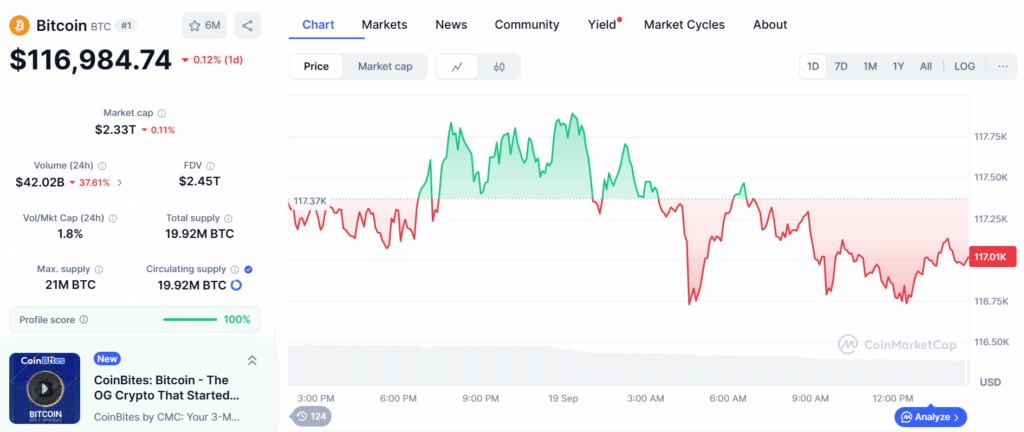

According to a report by Nasdaq, cryptocurrencies are extremely sensitive to monetary policies. Rate cuts facilitate flows into risky investments, BTC in this situation. Interestingly, Standard Chartered had underlined the possibility of a 50 bps cut in lending rate after the September FOMC meeting. BTC price is currently exchanging hands at $116,984.74, down by 0.12% in the last 24 hours.

The BTC price further reflects an increase of 1.55% in the last 7 days. Its 24-hour trading volume has plummeted by 37.61%, taking the value to $42.02 billion. Bitcoin token continues to dominate the global crypto sphere with a market cap of $2.33 trillion.

Estimates for BTC Price and ETH Price

The short-term BTC price prediction has estimated that it could rally to around $120,526 in the next 30 days. Ongoing volatility around BTC is 2.18%, and is backed by the 14-Day RSI of 61.94 points. Overall sentiments for the Bitcoin token are bullish with a neutral FGI rating of 53 points.

The short-term ETH price prediction has estimated that ETH price could breach the mark of $5,100 in the next 30 days. That would be a jump of approximately 11.43% from the current value amid the volatility of 3.24%. Sentiments for the Ethereum token are bullish despite the neutral FGI rating of 53 points.

It is important to note that the contents of this article are neither recommendations nor advice for crypto trading and investment.