- Florida’s HB 487 passed its first committee with unanimous approval on April 10.

- New Hampshire’s HB 302 passed the House and now awaits Senate review.

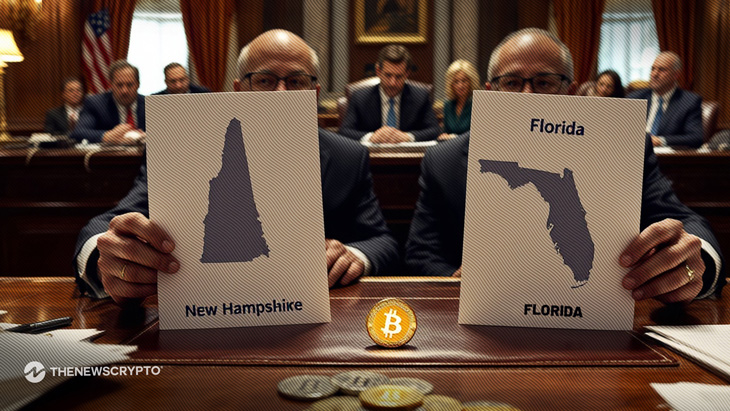

Florida has taken its first legislative step toward holding Bitcoin as a state reserve asset. On April 10, the House Insurance and Banking Subcommittee unanimously passed House Bill 487 (HB 487). This rare bipartisan support positions Florida alongside states like Arizona and New Hampshire in the Bitcoin reserve race.

Titled “Investments of Public Funds in Bitcoin,” HB 487 allows the Chief Financial Officer and State Board of Administration to invest up to 10% of select funds into Bitcoin. These funds include the General Revenue Fund and the Budget Stabilization Fund.

States Push Bitcoin Reserve Bills Forward

Florida’s bill permits Bitcoin investments through direct purchases, qualified custodians, or regulated exchange-traded products. It also allows Bitcoin holdings to be loaned or included in ETFs. This flexibility aims to maximize returns while maintaining state ownership and security.

The bill must now pass three more committees: Government Operations, Ways & Means, and Commerce. If it clears those, it will proceed to a full House vote. After that, the bill would move to the Senate and then to the governor’s desk.

Meanwhile, New Hampshire’s House passed its bill, HB 302, with a narrow 192–179 vote on the same day. That bill also allows up to 10% of state funds to be invested in Bitcoin and precious metals. However, it includes strict eligibility rules. Only cryptocurrencies with a market cap over $500 billion qualify. Currently, Bitcoin is the only asset that meets this threshold.

HB 302 now heads to the New Hampshire Senate. If approved, it will require Governor Kelly Ayotte’s signature to become law. The bill also sets guidelines for custody, requiring state-held assets to be stored securely via custodians or exchange-traded products.

Highlighted Crypto News Today

Magic Eden Ignites Over 11%, But Is It Built to Last?