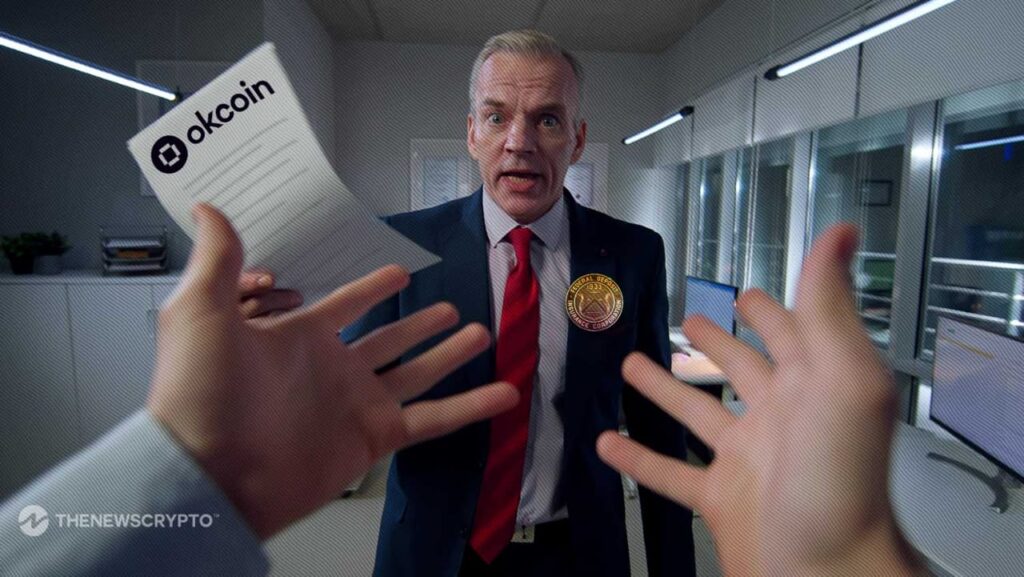

- The warning letter was sent to OKCoin’s CEO Hong Fang by FDIC.

- The agency has a set of rules that the crypto firms should implement.

The FDIC has warned the California-based cryptocurrency exchange OKCoin USA Inc., which is affiliated with the OKX, to avoid exploiting the FDIC’s name to strengthen its validity. The letter, sent to OKCoin’s CEO Hong Fang, raised concerns that the platform may be in breach of the FDIA’s Section 18(a)(4).

Moreover, any advertising or other written materials implying that an uninsured or possibly uninsured deposit is protected by the FDIC are in violation of this provision of the FDIA. The FDIC has now officially announced that insurance is not available in the case of OKCoin.

The authorities stated:

“OKCoin is not FDIC-insured and the FDIC does not insure non-deposit products. By not distinguishing between US-dollar deposits and crypto assets, the statements imply FDIC insurance coverage applies to all customer funds (including crypto assets). In addition, the FDIC does not insure or endorse particular blockchains. Accordingly, these statements are likely to mislead, and potentially harm, consumers.”

Comprehensive Set of Rules

The FDIC claims that on three different instances, including a tweet that has since been removed, an OKCoin executive falsely represented that customers’ savings were protected by the FDIC. Nonetheless, OKCoin’s promotional blog article still includes the FDIC insurance claim.

The Federal Deposit Insurance Corporation (FDIC) has issued a warning to crypto companies before about the dangers of claiming an endorsement from them. During the preceding year, letters of a similar kind were delivered to five other exchanges, including FTX and Voyager Digital.

When it comes to dealing with the FDIC, the agency has developed a comprehensive set of rules that the cryptocurrency business should implement.

Recommended For You:

Galaxy Digital’s Mike Novogratz Backs Blackrock’s Spot Bitcoin ETF