- Ethereum (ETH) price has gained approximately 20% this month, indicating a strong bullish reversal in the crypto market.

- Post-approval of the ETH ETF, Ethereum-based tokens have experienced increased price volatility, signaling growing investor interest.

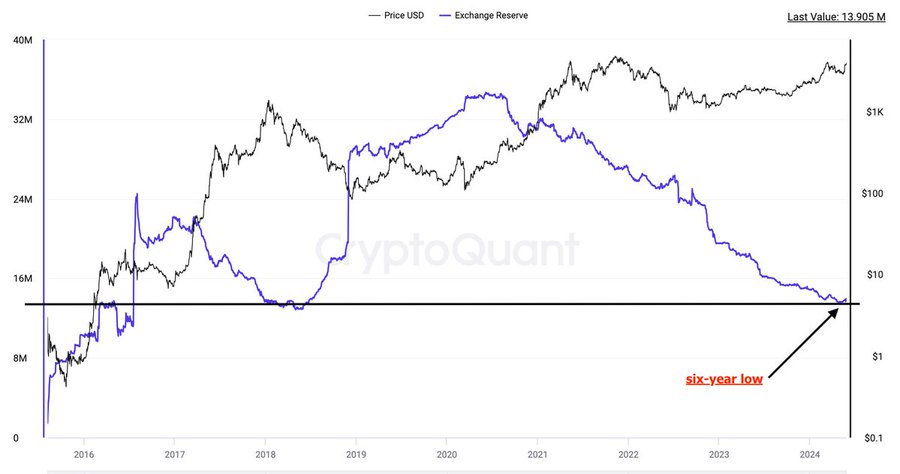

- On-chain data reveals a decline in Ethereum exchange reserves since mid-2020.

The altcoin leader, Ethereum (ETH), has witnessed a 20% growth in its portfolio this month, signaling a strong bullish reversal in the cryptocurrency market. As speculation about an impending altseason intensifies, the ETH price continues to hold above a crucial support level.

Following the approval of the ETH ETF, Ethereum-based tokens have experienced heightened price volatility, indicating a growing interest among investors in these altcoins. With the ETH price on the verge of reclaiming the $4,000 mark, the question arises: Will Ethereum reach a new all-time high in the near future?

In this article, we delve into the short-term price analysis and on-chain sentiments of ETH tokens to provide insights into these pressing questions.

ETH Price Exhibits Bullish Price Action

After trading within a confined range between $3,017 and $3,400 for over three weeks, displaying a neutral trend, the ETH price regained momentum following the approval of the spot Ethereum ETF. This development resulted in the altcoin adding an impressive 28% to its portfolio within a short period.

Ethereum’s price has gained 1.81% within the past day, accompanied by a 4.86% increase in trading volume, reaching $18.552 billion. At the time of writing, the price of ETH stands at $3,908, with a circulating supply of 120,137,632 ETH tokens.

Ethereum On-Chain Sentiments

Ethereum’s exchange reserves have been steadily declining since mid-2020, signaling an increase in cryptocurrency adoption within the cross-border financial system. Moreover, this decrease in exchange reserves has been accompanied by significant growth in the number of long-term investors.

During the last trading week of May 2024, Ethereum’s exchange reserves hit a 6-year low, with a recorded value of only 13.905 million ETH. This highlights a decline in the selling pressure on Ethereum tokens and an increasing number of hodlers in the cryptocurrency market.

This reduction in supply could potentially pave the way for the Ethereum (ETH) price to reach the $10,000 level in the future.

If the market maintains its momentum, the Ethereum price is expected to test its resistance level of $4,094.75. Sustaining the price above this level will set the stage for ETH to prepare for a retest of its upper resistance level of $4,500 in the upcoming weeks.