- Spot trading volumes on all centralized crypto exchanges dropped 1.34%.

- Futures trading increased 13.4% to $3.12 trillion.

Despite the market volatility, Bitcoin (BTC) and Ethereum (ETH) had regained dominance over future trading volume, according to an evaluation of respective spot trading volumes. In July, Bitcoin and Ethereum closed at $23,332 and $1,681 with price gains of 22.0% and 62.8%. And trading volumes on centralized exchanges increased by 8.39% to $4.51 trillion.

Last month, spot trading volumes on all centralized cryptocurrency exchanges dropped 1.34% to $1.39 trillion, the lowest monthly trading volume since December 2020. Meanwhile, the level of futures trading increased for the first time since March, rising 13.4% to $3.12 trillion, which indicates a rise in speculative activity.

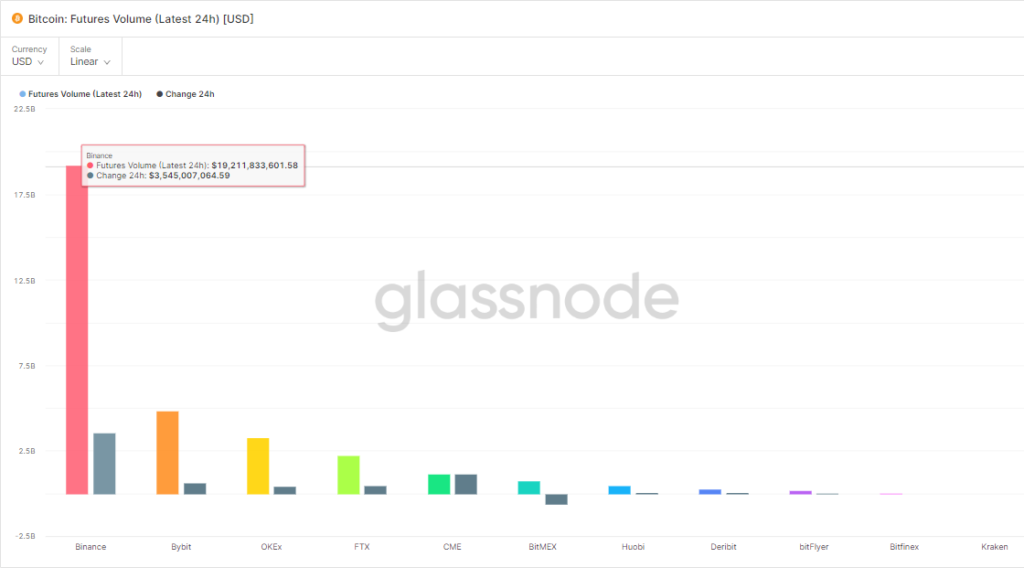

According to the report from cryptocompare, Binance is still the top exchange by spot trading volume with a market share of 54.0% and a gain of 10.3% to $439 billion. At the same time, spot trade volume on Coinbase decreased further, falling 12.8% to $51.5 billion.

BTC and ETH Trading Volume

Through the first half of 2021, Bitcoin’s futures/spot ratio was significantly greater than Ethereum’s. Following that, spot volume took control as the price of bitcoin peaked in Q4 of 2021. Although, the recent market break, both ratios moved and sank into equilibrium.

Futures trading has revived its position since June 2022, which has caused a spike in futures volume relative to spot volume. However, from June, the Ethereum futures/spot ratio took up relative to the BTC ratio, due to price speculating on the impending upgrade event.

The volume of BTC and ETH futures recently increased, which shows that derivatives traders have resumed speculating on crypto assets. But when comparing the future trading volume of Bitcoin and Ethereum, ETH has taken leading over BTC, due to the transition of the Proof of Work (PoW) to the Proof of Stake (PoS) mechanism “the Merge”.