- The Ethereum Foundation sold approximately $1.94 million worth of ETH tokens in the past week.

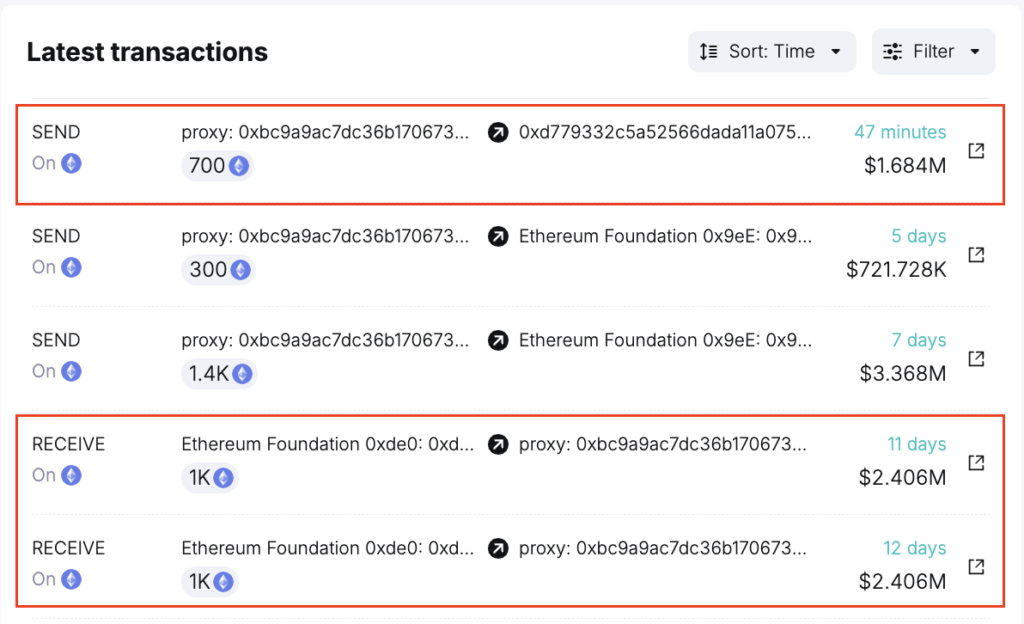

- The sale was conducted in two separate transactions, totaling 800 ETH, and converted into 1.68 million USDC, a stablecoin pegged to the U.S. dollar.

- The funds from the sale were transferred to the Ethereum Foundation’s treasury for ongoing development and ecosystem support.

The nonprofit Ethereum Foundation sold off approximately $1.94 million worth of its native ETH tokens this past week, adding pressure amid an already fluctuating cryptocurrency market.

According to blockchain analytics provider Spotonchain, the foundation liquidated over 800 ETH across two wallet addresses in under an hour on Wednesday. The sales came in separate chunks, equating to 1.68 million USD Coin (USDC), a stablecoin pegged to the U.S. dollar.

The funds were subsequently transferred to the Foundation’s treasury to fund ongoing development efforts and broader ecosystem support, as outlined in its guiding mission.

Ethereum transaction occurred just above a crucial support zone

The transactions occurred just above a crucial support zone for Ethereum, spanning $2,388 to $2,460. Prices have hovered in that area after a failed breakout earlier this month.

While the added sell-side activity didn’t single-handedly sink prices further, it contributed to already shaky sentiment and technical weakness. Some analysts eye the range as make-or-break for avoiding a potential plunge back toward the $2,000 threshold.

And yet, the salvo didn’t dissuade all market participants from scenting opportunity amid the volatility. Per the findings, a separate whale wallet acquired nearly 8,000 ETH, valued at around $19 million, during the market shakeout.

Researchers suggest the investor deliberately targeted the support-turned-resistance zone to accumulate greater ETH exposure at favorable rates. Other metrics indicate just 10% of ETH holders are currently underwater on their initial investments.

Still, the foundation sale introduces more uncertainty on whether overstretched support levels can withstand much more adverse pressure. For now, buyers are clinging to the current range lows in hopes of reversing momentum.

Failure to respond risks a breakdown that leaves little standing in the way of drastically lower levels that would mark a technical disaster. With the news flow and prevailing winds turning increasingly bearish, Ethereum bulls face serious tests in the coming sessions.