- Ethereum poised for consolidation before aiming for $4,000 again, indicated by Pi Cycle Top Indicator.

- Ethereum finds robust support between short-term and long-term moving averages, signaling stability and potential consolidation.

- ETH’s NUPL oscillates between “Optimism — Anxiety” and “Belief — Denial” zones, reflecting balanced sentiment for gradual price climbs amidst consolidation.

Ethereum (ETH) finds itself at a crucial juncture. According to recent price analysis, ETH could be entering a period of consolidation before attempting to reach the $4,000 mark once again.

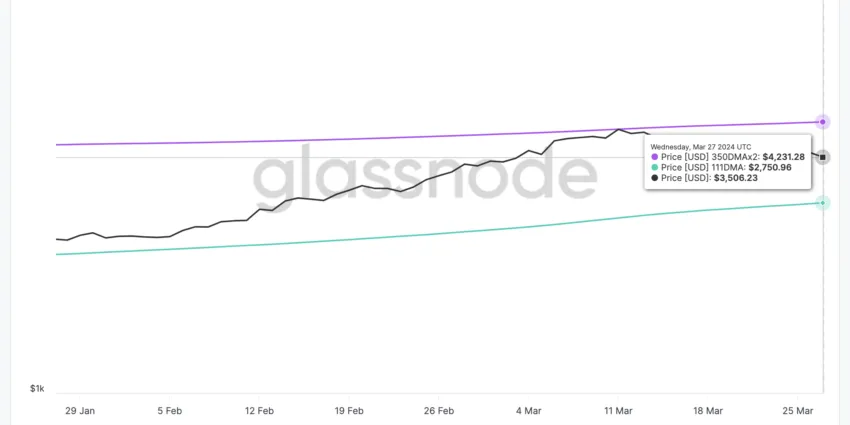

Ethereum is currently in a brewing consolidation phase, according to the Pi Cycle Top Indicator, a tool for identifying potential market tops. The indicator’s upper boundary is set near $4,231, while the lower boundary rests around $2,750, creating a bandwidth that allows for market stabilization rather than a peak.

Ethereum’s Position Between Averages Indicates Robust Support

Positioned between the short-term (111-day) and long-term (350-day multiplied by 2) moving averages, the current ETH price’s parallel trajectory without a crossover event suggests the establishment of a robust support level. The current price activity and this lack of convergence support the idea that ETH may be entering a consolidation phase.

When the price surpasses the longer-term average, it could indicate an overheated market poised for a downturn. On the other hand, if the price falls below the short-term average, it could indicate an asset’s undervaluation. Ethereum’s position between these averages hints at a potential period of stable growth.

NUPL Oscillation Reflects Market Indecision and Sentiment Balance

The Net Unrealized Profit/Loss (NUPL) indicator for Ethereum has been consistently oscillating between the “Optimism — Anxiety” and “Belief — Denial” zones, reflecting the market’s indecision.

This pattern suggests that investors are alternating between cautious optimism and a stronger conviction in the asset’s potential, without fully committing to an overarching trend.

The NUPL’s brief stays in the “Belief — Denial” zone help prevent market overheating, while the sentiment balance between zones may prepare ETH’s price for steady climbs. Without strong greed or fear dominating the market, a gradual rise in Ethereum’s price is more likely than volatile swings.

The current consolidation phase could provide a foundation for a stable uptrend, but it is crucial to approach the market with caution and consider the potential risks.