- The Digital Chamber launched a working group to defend CFTC oversight of prediction markets.

- State regulators have intensified legal action against Kalshi and Polymarket.

- Courts may decide whether prediction markets fall under federal derivatives law or state gambling rules.

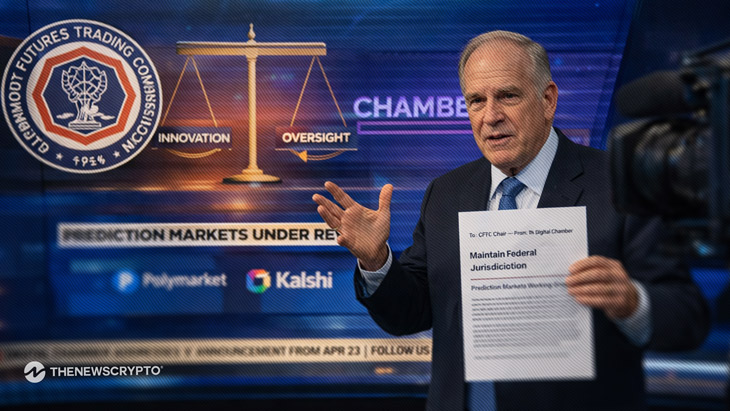

The Digital Chamber has launched a new Prediction Markets Working Group to strengthen federal oversight of the sector in the United States. The blockchain advocacy group aims to secure regulatory clarity and reinforce the Commodity Futures Trading Commission’s authority over event-based contracts.

The organization announced the initiative on X and outlined a multi-year strategy to shape policy. It described prediction markets as a misunderstood segment of finance that needs structured rulemaking rather than enforcement-driven actions.

Letter to CFTC Chair Signals Federal Push

The first official letter was sent to CFTC Chairman Mike Selig by the Digital Chamber of Commerce. The group welcomed Chairman Selig’s recent statements in support of tailored guidance for prediction markets. They urged the agency to maintain its primary jurisdiction and avoid regulatory duplication with state authorities.

The organization argued that companies in the sector face confusion due to conflicting state and federal rules. It emphasized that the CFTC has regulated event contracts for more than two decades. The working group plans to draft policy principles, publish research, and build a coalition of stakeholders to support federal oversight.

The group also intends to participate in litigation through friend-of-the-court briefs. It wants to educate courts about what it views as the CFTC’s historic regulatory exclusivity over prediction contracts.

State Enforcement Actions Escalate

State regulators have increased pressure on major platforms. The Nevada Gaming Control Board recently filed a civil enforcement action against Kalshi. Regulators want to block the company from offering contracts that they classify as unlicensed wagering products.

Polymarket has faced similar scrutiny. Massachusetts officials have questioned its sports-related contracts. In response, Polymarket filed a federal lawsuit to prevent possible state enforcement. The company claims that federal law regarding derivatives applies to their contracts, not state gaming laws.

CFTC Chairman Mike Selig has been quoted as supporting federal authority over the industry. He said that prediction markets are not a new phenomenon and that the CFTC has been regulating them for several decades.

Utah Governor Spencer Cox strongly condemned this position. He called prediction markets a form of gambling and said they negatively impact society. This reflects the political split on the regulation of event-based financial products.

Courts May Define the Sector’s Future

The current legal issue is one of classification. If the courts uphold the CFTC’s authority, prediction platforms may receive a stable federal regulatory framework. If the states win, firms could be subject to patchwork licensing regulations.

You can examine the federal regulatory framework for derivatives and event contracts on the official CFTC website. Analysts also monitor the latest state gambling laws, for example, through the National Conference of State Legislatures.

The Digital Chamber of Commerce expects that a clearer regulatory framework will foster innovation and participation. Others fear that increased mainstream acceptance may lead to the blurring of the lines between finance and gambling. Time will tell which view will prevail.

At this juncture in the litigation process, prediction markets are at a regulatory crossroads. Industry representatives call for a federal regulatory framework. State authorities call for greater regulation.

Highlighted Crypto News:

Centrifuge and Pharos Partner to Expand Onchain Access for Institutional Assets