- FTX will begin repaying creditors in Q4 2024, distributing $16 billion while liquidating all assets.

- The SEC and U.S. trustee have raised concerns over FTX’s repayment plan.

FTX, the crypto exchange that faced bankruptcy in November 2022 is planning to repay creditors in the fourth quarter of 2024 which is starting this October. They are redistributing 16 billion dollars. It owes more than two million customers and other non-governmental creditors about $11 billion.

This vital move marks a crucial step in the recovery process for the company. It seeks to tackle the significant financial liabilities accumulated before its collapse. Crypto investors are expecting a huge liquidity influx.

During the FTX crash, there was a huge withdrawal. They filed a bankruptcy not being able to fill the multi-billion dollar gap. On January 31, 2024, FTX announced it would not relaunch its cryptocurrency exchange. Instead, the company will liquidate all assets and return the funds to customers. Reimbursement will be calculated based on the cryptocurrency prices as of November 2022, when FTX collapsed.

The exact repayment schedules have yet to be fully outlined. FTX aims to ensure fair payments while managing its available financial resources. Each creditor will receive payments according to the terms negotiated during the bankruptcy process.

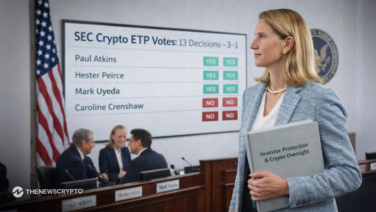

The SEC Issued a Warning Over FTX’s Plans

The crypto exchange had earlier proposed a restructuring plan to repay creditors up to 118% of their claims. However, this offer was restricted to those with claims of $50,000 or less.

The exchange faces a challenge from the U.S. SEC regarding its repayment schedule. Although FTX proposed using stablecoins, the SEC has reserved the right to contest this approach, despite stablecoin payments not being explicitly illegal. The SEC can challenge any transactions involving cryptocurrency assets if they do not comply with federal securities laws.

Highlighted Crypto News Today:

Is the SEC Lagging Behind in Digital Asset Regulation?