The stock market has always influenced cryptocurrency and DeFi tokens. A direct consequence of Amazon’s move will be felt by holders of DeFi tokens that reflect AMZN stock on the crypto market.

Amazon’s Stock Break Up

On June 6th, the 20:1 stock split went into effect, dividing each existing AMZN share into 20 separate pieces. The shares are now trading at $128 per share. However, this split will not affect the firm’s fundamentals, but new investors will have additional options to participate in the company. Before the split, most small investors couldn’t afford to buy Amazon stock.

The stock split is a great way to bring in new investors, but the impact on the DeFi tokens representing it isn’t quite what one would anticipate.

Several different initiatives are offering decentralized tokens reflecting real-world equities. DeFiChain, for example, allows users to mint and trade dAMZN, which closely tracks the Amazon stock in DeFi to provide price sensitivity (but not ownership). DeFiChain dAMZN replicates stock prices by monitoring and reflecting several variable aspects and using oracles to gather these feeds, as do all dTokens.

In order to mint the allotted dToken, one must own 50 percent of DFI and 50 percent of any other asset combination. DeFiChain’s decentralized stablecoin dUSD may be used to mint a dToken if investors do not want to give a combination of DFI and other assets. These dTokens are designed to imitate the underlying asset’s price movement, allowing users to invest in and withdraw funds in their preferred stock without going via a bank.

Like Amazon stock, the token will be divided into 20 equal parts. DeFi coin holders will get 20 tokens for each of their dAMZN tokens, but their investment will not rise by 20 times. Investors will own the same amount of dAMZN as before to the split when DeFiChain updates the dAMZN price from the oracles.

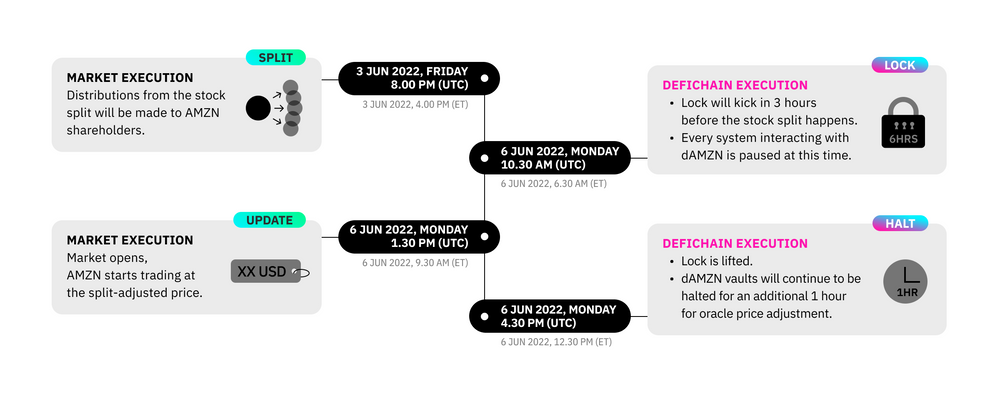

There were two phases to the stock split. Locking all dAMZN tokens, DeFiChain then started representing the price of the stock market when it reopened after the split adjustment. One of the reasons why dAMZN and other DeFiChain tokens are seeing gains is because the typical investing method takes too much time from a person. Investing in DeFi tokens, on the other hand, does not need the same amount of time-consuming processing as doing so in TradeFi.

Furthermore, many investors have been unable to invest in their favorite US equities due to regional limitations and trading restraints. For these traders and investors to obtain price exposure to such assets from anywhere in the globe, DeFiChain is using dTokens.

In addition, a fractional portion of a token may be purchased; for example, one could acquire 1/10th of the dTSLA token, which is very hard to locate on the spot market. While the sky is the limit of one’s imagination, DeFiChain understands how to push it much farther than that.

DeFiChain enables users to increase the return of their dTokens by using liquidity mining instead of just holding the stock to receive more rewards. Accordingly, dAMZN token holders will not be harmed significantly by Amazon’s 20 for 1 split, which was carried out successfully.