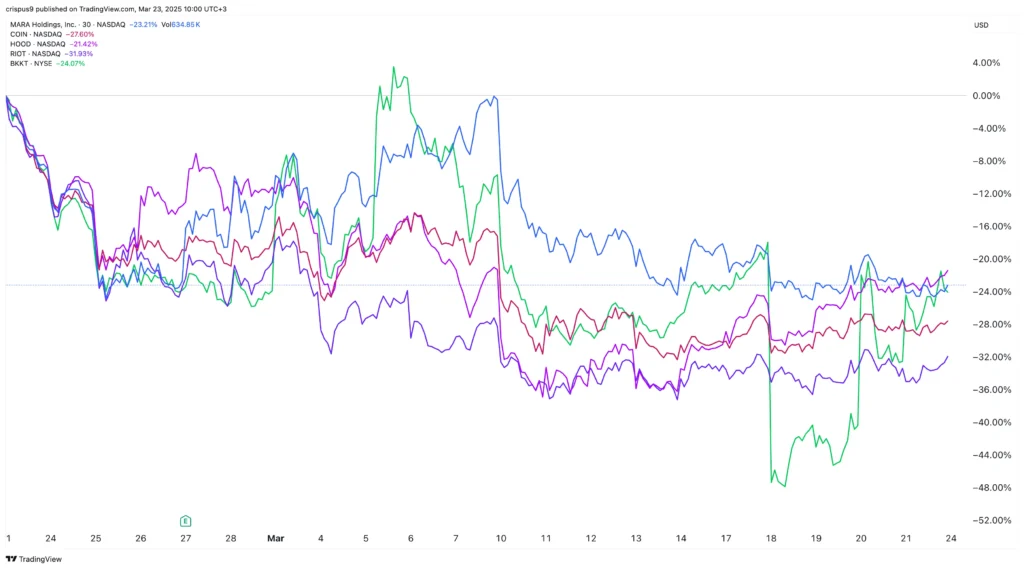

- Crypto stock market crash happened as Bitcoin’s decline drags the market down.

- Mining firms like Marathon Digital and Riot Blockchain are facing steep losses.

- The U.S. government and SEC are adopting a more crypto-friendly stance despite the slump.

The digital currency market is in free fall, taking top crypto-related stocks with it. Bitcoin’s decline has shaken the industry, with big exchanges, trading venues, and mining companies falling victim to it.

Coinbase Drops

Coinbase, the largest US cryptocurrency exchange, had its stock fall from close to $350 a share in November to $190. This steep plunge has caused a huge loss of market capitalization, from $86 billion to $48 billion, which represents a $38 billion drop.

MicroStrategy’s Bitcoin Strategy Under Pressure

MicroStrategy, rebranded as Strategy, has also taken a big hit. The firm, which continues to add Bitcoin to its balance sheet, has lost market capitalization from $106 billion in the previous year to $79 billion.

With 499,226 Bitcoins on its balance sheet, the firm’s fate is still directly linked to the price action of Bitcoin.

Robinhood, once known for retail trading, is now a force to be reckoned with in the cryptocurrency world. Its shares, though, have not escaped the downturn in the market, falling from a high of $66.85 this year to $45. The fall has wiped out about $18 billion in value.

Robinhood has not let such challenges deter it from further expanding its footprint in the crypto arena, especially with its acquisition of BitStamp scheduled later this year.

Bitcoin Miners under Strain

Companies involved in mining Bitcoin have experienced a rough blow as decreasing BTC prices compress profitability margins. Mara Holdings, a company once recognized as Marathon Digital, lost more than $4.6 billion in its market value.

Several other mining businesses, such as Riot Blockchain, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf, too, posted multi-billion-dollar losses.

The decline in the crypto market has resulted in a substantial drop in overall market capitalization. The overall worth of all cryptocurrencies has fallen from more than $3.7 trillion in 2024 to $2.7 trillion now, as reported by CoinMarketCap.

Bitcoin alone has taken a dramatic fall, dropping from $109,300 in January to $85,000. Altcoins have performed even worse, with Solana-based meme coins losing more than $18 billion in worth.

Regulatory Developments and Market Crash

In spite of the decline, the regulatory environment has become more positive. The U.S. government has committed to backing the industry through projects such as the Strategic Bitcoin Reserve.

The Securities and Exchange Commission (SEC) has also become more welcoming, settling lawsuits against leading players in the industry such as Coinbase, Ripple Labs, and Kraken.

The fate of crypto stocks is unclear. Some analysts expect the recovery, while others believe the market slump means the bull run of the latest phase has ended. Standard Chartered has modeled Bitcoin to rise to $500,000 in the long run, while Ki Young Ju, the founder of CryptoQuant, thinks all signs are currently pointing towards a bearish future.

As the market rides out this trying time, investors and sector players alike will pay close attention to any indications of a turnaround or continuing slide in the coming months.