- 2000 Australia native crypto wallets have been swindled by “approval-phishing” scam.

- Tether to use Chainalysis tools to monitor its stablecoin activity on the secondary market.

Recently, Chainalysis’s “ Operation Spincaster” revealed that over 2000 crypto wallets have been compromised by “approval phishing scams” in Australia. The Australian Federal Police (AFP) is examining the financial losses from these attacks impacting a large number of users.

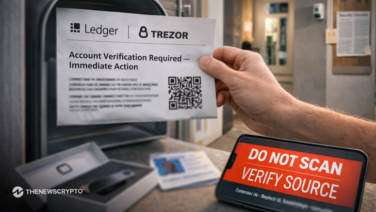

Approval of phishing scams involves deceiving users into authorizing fraudulent transactions. These scams are often linked to fraudulent investment schemes promising unrealistic returns known as “pig-butchering” scams.

Tim Stainton, AFP Detective Superintendent, stated that Spincaster revealed new tactics used by the illicit technocrats to defraud the users. Intelligence has provided crucial insights into these evolving scams. He highlighted that this information will be crucial for ongoing investigations aimed at identifying victims and disrupting offenders.

The collaboration between Chainalysis and the AFP’s Policing Cybercrime Coordination Center (PCCC) has led to an all-inclusive approach in tackling scams. Meanwhile, major cryptocurrency exchanges like BTC Markets, Binance, and Crypto.com are strengthening their security to protect Australian users from scams.

Australian banks are also acting by imposing restrictions or blocks on transfers to crypto exchanges to prevent scam-related losses. The list includes HSBC, Commonwealth Bank, National Australia Bank, Westpac, and Australia and New Zealand Banking Group — Bendigo Bank.

Can Tether New Tools and Global Crackdown End the Crypto Crisis?

In May 2024, Tether announced its use of Chainalysis tools to monitor its stablecoin to identify illicit or sanctioned addresses. The solution includes Sanctions Monitoring, Illicit Transfer Detector, Categorization by holder type, and Largest Wallet Analysis to track USDT holders.

Since May 2021, Australians have reported losing approximately $4 billion to approval phishing scams. The initiative spanned across 6 countries, involving 12 agencies and 17 exchanges, tracking 7,000+ criminal leads.

Moreover in 2023 alone, investment scams have resulted in a $840 million loss, according to the country’s competition and consumer regulator. As the investigation continues, both law enforcement and financial institutions are strengthening. They put in efforts to combat cryptocurrency fraud and safeguard Australians from future scams.

Highlighted Crypto News Today:

How Did Major Cryptos Bitcoin and Ethereum Crash Overnight?