- DeFi faces higher risks and lower yields, with a 15% TVL drop.

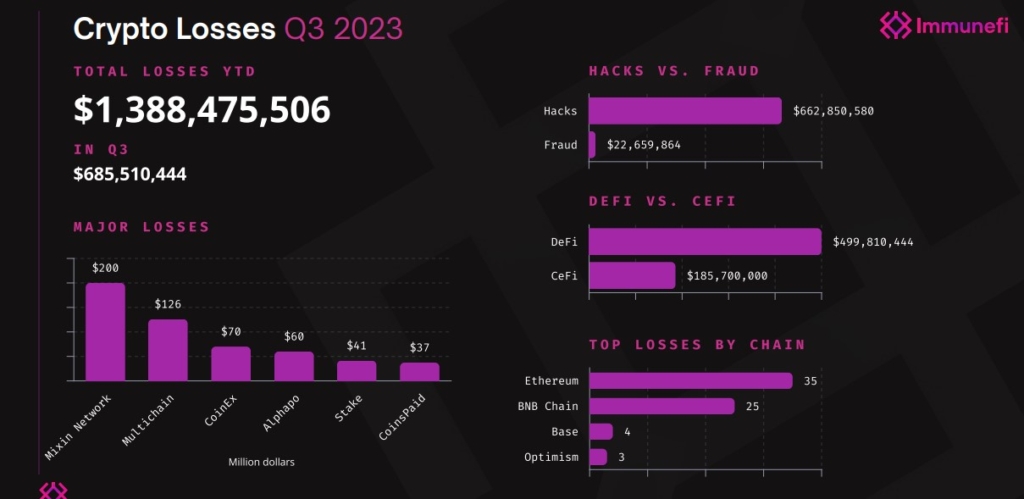

- A total of $685,510,444 was lost during the third quarter of 2023.

While crypto enthusiasts are currently rejoicing in the market’s upward momentum, there are still individuals who haven’t moved on from the challenges of Q3 2023. The quarters of July, August, and September of 2023 marked a bear-driven phase with staggering losses across the Web3 ecosystem.

In total, $685,510,444 was lost during Q3 2023, with $662,850,580 falling victim to hacks in 49 specific incidents and $22,659,864 lost to fraud across 27 specific incidents.

DeFi in particular, proved to be highly susceptible to scams, rug pulls, and hacks during the tumultuous quarter. DeFi accounted for 72.9% of the total losses, leaving CeFi with just 27.1%.

Q3 2023: A Risky Space?

Q3 2023 witnessed a surge in the number of attacks, with the number of single incidents increasing by a staggering 153% compared to the previous year, jumping from 30 to 76. The total losses also saw a significant uptick, soaring by 59.9% compared to Q3 2022. It reached the substantial figure of $685,510,444.

Consequently, Q3 2023 stands out as the quarter with the highest losses throughout the year. Ethereum blockchain, once again, surpassed BNB Chain and claimed the title of the most targeted chain. Since its launch in early August, the Coinbase-backed Base protocol has experienced losses across four projects, sharing the spotlight with Ethereum. And BNB Chain, according to Immunefi, Web3’s leading bug bounty platform report.

DeFi Dilemma

The prevalence of hacks and rug pulls in the DeFi space has become increasingly common in the Q3. Furthermore, DeFi has been adversely affected by a reduction in volume, leverage, and liquidity mining programs, resulting in users experiencing lower yields on their assets.

Research indicates that the diminished rewards and heightened risks have rendered DeFi less appealing at this juncture, leading to a notable 15% decline in Total Value Locked (TVL), plummeting from $45.5 billion to $35.5 billion. DeFi’s total volume currently stands at $5.64 billion, accounting for 8.23% of the entire cryptocurrency market’s 24-hour trading volume.

In the midst of these challenges, a comparative analysis of losses incurred by CeFi and DeFi between Q3 2022 and Q3 2023 underscores the extent of the issue. DeFi reports losses have surged by 18.1% in comparison to the previous period. While CeFi losses have skyrocketed by 3,409% during the same timeframe.

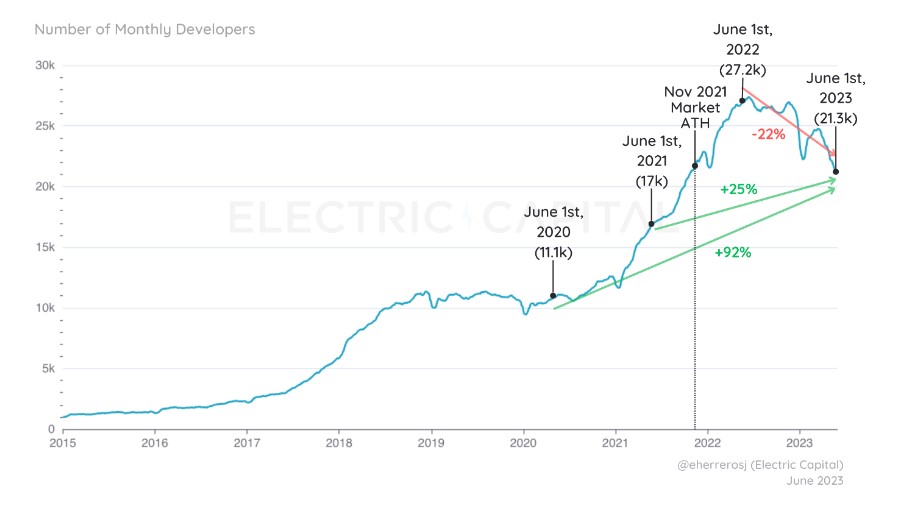

Despite these hurdles, the anticipated updates to DeFi protocols and the developer activity rate, which has reached its highest level since November 2021, remain conspicuously absent.

Top Scams

A significant portion of the losses in Q3 was attributed to two specific projects, Mixin Network and Multichain, which collectively accounted for $326,000,000, or 47.5% of Q3 losses. In a notable incident, on September 23rd, 2023, the decentralized Mixin network was breached. It resulted in cybercriminals making off with $200 million-worth of digital tokens.

Multichain experienced its own hack on July 7th, 2023, involving the withdrawal of an estimated $126 million in assets. It affects tokens like DAI, Link, USDC, WBTC, and wETH.

What Lies Ahead?

The crypto community remains optimistic that the market won’t face challenges as severe as those in Q3 2023. With the current upward momentum and bullish hopes circulating around Bitcoin ETF approval. And the nearing Bitcoin halving, the future appears hopeful for the crypto space.

Are you optimistic about the Q4 market situation? Share us your thought by tweeting us @The_NewsCrypto