- Coinbase defenses with major questions doctrine, abuse of discretion, equitable estoppel, unclean hands, and laches.

- The first hearing between Coinbase and the SEC will play a significant role in shaping the litigation.

Coinbase, the second largest cryptocurrency exchange, and the U.S. Securities and Exchange Commission (SEC) entered the courtroom today for the first time as part of the SEC’s lawsuit against the crypto exchange. The outcome of this legal battle holds implications not only for Coinbase but also for the global crypto industry.

According to Coinbase’s Chief Legal Officer, Paul Grewal, the exchange has responded to the SEC’s statement and is prepared to address the court during the hearing. Coinbase has been vocal about the need for regulatory clarity in the crypto industry. And has sought to demonstrate that the current legal framework is insufficient for participants to navigate.

We have responded to the SEC’s statement of intent to move to strike Coinbase’s defenses rooted in the major questions doctrine, abuse of discretion, equitable estoppel, unclean hands, and laches. We look forward to addressing the Court tomorrow morning. pic.twitter.com/hNk5SoGyD1

— paulgrewal.eth (@iampaulgrewal) July 12, 2023

Lawsuit Allegations: SEC vs Coinbase

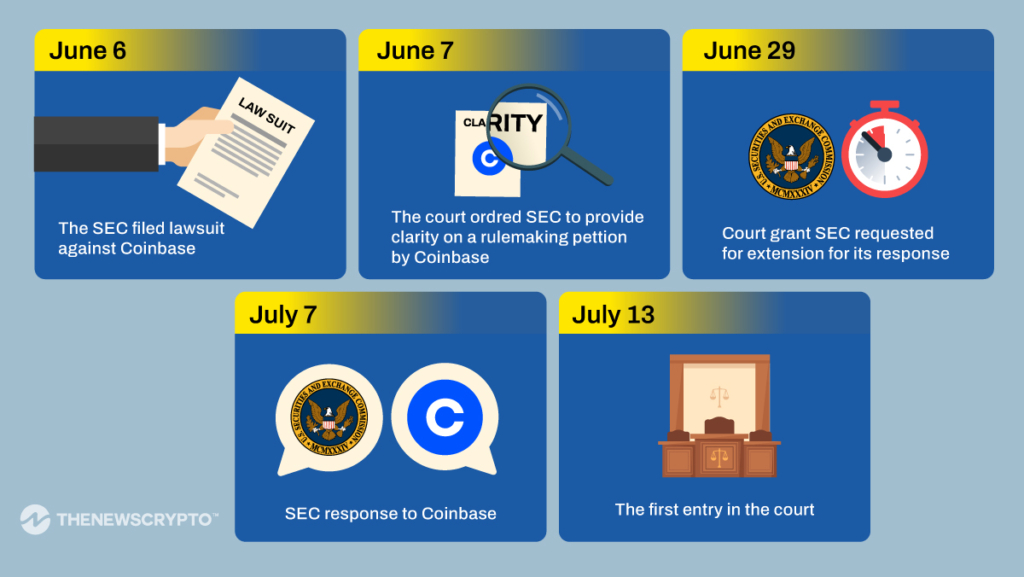

The lawsuit, filed by the SEC in early June, accuses Coinbase of operating as a broker, exchange, and clearinghouse for unregistered securities. Also, the SEC claims that 13 different cryptocurrencies listed on the exchange meet the requirements of the Howey Test. The Howey Test is a legal evaluation in the United States to determine whether a transaction qualifies as an investment contract, indicating that it should be classified as a security under federal law.

If the parties involved in the case do not reach a settlement, it is expected that the ongoing litigation will continue for several years. Similar to the SEC vs Ripple Labs lawsuit which has been ongoing for three years.

However, the pre-motion hearing held today, expected to set the tone for the litigation and shed light on its potential impacts on the global crypto market. The outcome could have significant upshot for other exchanges and industry players. Including Binance as they navigate compliance with federal securities laws.

Further, Coinbase has been proactive in its legal defense. Signaling its intentions and publishing a blog post when it received a Wells Notice from the SEC. Also, the exchange has argued that the SEC’s actions violate its due process rights. And that the agency is attempting to preempt Congress by pursuing the lawsuit.

Recommended for you