- Bitcoin fell below $94K as Trump’s tariffs sparked a massive sell-off.

- Analysts weigh in on implications of Trump’s economic decisions, and impacts on digital assets.

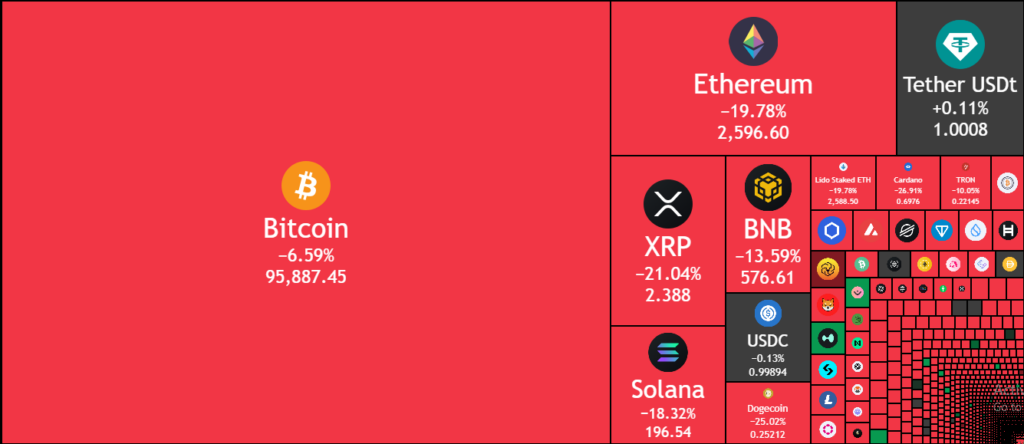

The cryptocurrency industry has hit another downturn as US President Donald Trump’s latest tariff decisions. Trump’s tariff decision caused a market shock, Bitcoin (BTC) fell below $94,000 and recorded an intraday low of $91,242, a clear loss from its recent highs. Ethereum (ETH) also plummeted over 26% to $2,159, causing panic among investors.

Trump’s decision to impose a huge 25% tariff on imports from Mexico and Canada, along with a 10% levy on Chinese goods, has sparked fears of a full-scale trade war. Also, the move provoked retaliatory threats from affected nations, raising concerns about escalating economic instability.

In sharp response to Trump’s tariff policies, Canada will now impose a 25% Tariff on $155 Billion worth of US goods.

Crypto Market Faces Billions in Liquidations Amid Severe Panic

Bitcoin’s decline to the $91K zone wiped out nearly $2.27 billion from the overall crypto market, including $1.89 billion in long positions within 12 hours, according to Coinglass market data. In the past 24 hours, 745,971 traders were liquidated. CoinGecko showed how holders began selling, signaling a shift in sentiment. Ethereum saw even steeper losses, dropping to $2,135 in its worst intraday decline since 2021.

Memecoins and altcoins were not spared. DOGE plunged 23%, XRP shed 21.6%, and Solana slipped 8%. The crypto market lost nearly $2 billion in value as a result of the Tariff decision and global economic policies.

Robert Kiyosaki, an intelligent investor and acclaimed author, expressed his rare views.

“Gold, silver, and Bitcoin may crash—good. Crashes mean assets are on sale. Time to get richer,” he tweeted.

Analysts Warn of More Volatility as Trade War Escalates

Trump’s tariffs have already strained relations with Canada, Mexico, and China, with retaliatory measures expected. The European Union has hinted at countermeasures if similar tariffs extend to its member states.

The financial fallout has been severe across global markets. The dollar surged, while equities and risk assets tumbled. US stock futures dropped 2%, and European stocks saw a 2.8% decline. Analysts warn that prolonged trade tensions could further destabilize both traditional and crypto markets.

According to Jorge Montepeque, Director of Benchmark, in a podcast, he described, “Trump’s proposed tariffs are just economically “dumb.”

Despite challenges, Bitcoin still dominates the digital sector, with over 60% market share and a possible recovery as it’s set for a bullish rebound.

With the Federal Reserve maintaining a cautious stance and global markets on edge, the next moves in this unfolding trade war could define the trajectory of crypto for months to come.

Highlighted Crypto News for Today:

Dogecoin (DOGE) Suffers 16% Plunge Amidst Crypto Market Crash