- April’s CPI data is anticipated to reveal 3.3% to 3.4% inflation rates, surpassing the Fed’s 2% target.

- The cryptocurrency market saw major swings, Bitcoin’s price dropped over 5% in just one week.

Inflation concerns persist as the U.S. Bureau of Labor Statistics gears up to unveil the April Consumer Price Index (CPI) data on May 15. The projections suggest that April’s CPI could range between 3.3% and 3.4%, the figures could amplify worries about inflation running higher than the Federal Reserve’s target goal of 2%.

With inflation persisting above target levels, the Federal Open Market Committee (FOMC) is expected to hold off on interest rate cuts until July or later, delaying monetary policy adjustments to address the inflationary pressures.

Crypto Market Continues to Bleed

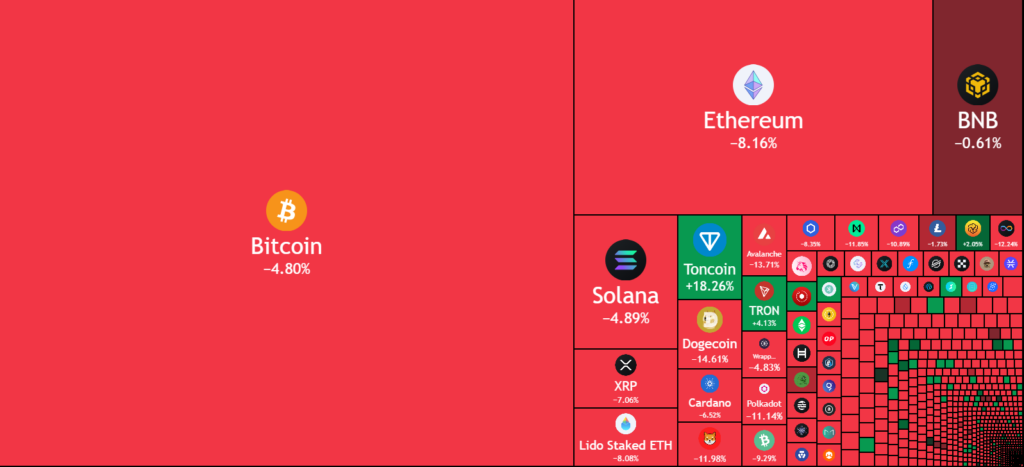

In the midst of economic uncertainty, the cryptocurrency market witnessed significant volatility over the past weekend. Bitcoin, the leading cryptocurrency, experienced a 5.14% decline, dipping below the $60,500 mark before rebounding slightly to $60,959 at the time of reporting.

Ethereum and other altcoins followed suit, with ETH trading at $2,884, marking an 8.62% decrease over the past week, according to CoinMarketCap data. The heightened selling pressure across the crypto market led to corrections ranging from 4–10% among the top ten cryptocurrencies.

As economic indicators sway and crypto markets fluctuate, investors brace themselves for potential impacts on monetary policy and asset values in the weeks ahead.