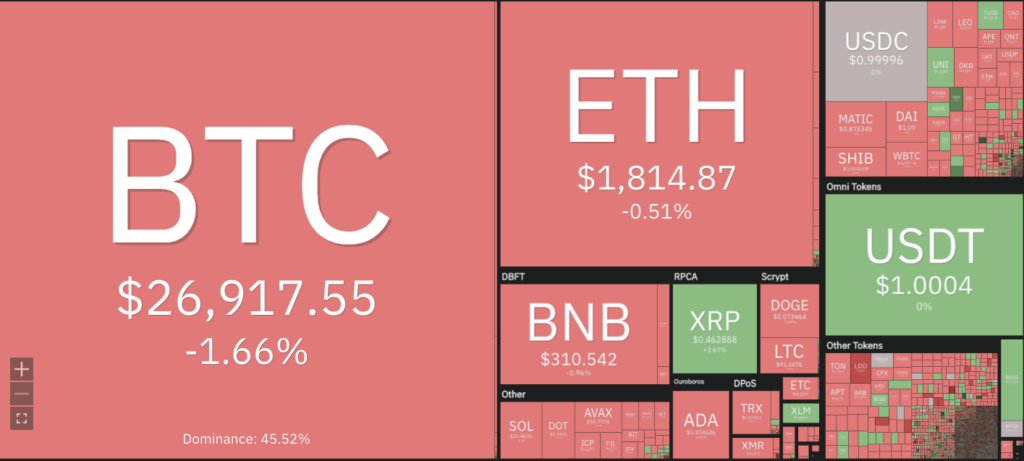

- Most of the cryptocurrencies are trading in the bearish territory today.

- BTC/USD is hovering around the $26,917 level, down by 1.66%.

- The altcoins are trading around their support levels with a bearish bias.

Today price analysis shows that most of the cryptocurrencies are trading in the red zone. The bearish market sentiment has taken a toll on the prices of major digital assets. The previous days the bulls had managed to push the prices higher but failed to retain the gains and have since been struggling.

BTC/USD is currently trading around the $26,917 level, down 1.66%. The pair has been unable to break past the resistance of $27,466, which has prevented BTC from any further gains. It could reach the $28,000 level if it breaks past this resistance. For the past few days, BTC has been trading between $26,000 and $27,500.

The ETH/USD pair shows that the bears are still in control of the market, trading around the $1,814 level with a bearish bias. The selling pressure has kept the pair subdued, and it is unlikely to break past the $1,831 level soon.

The pair will likely stay range bound within the $1,774-$1,831 mark for some time. The bulls are struggling to maintain their gains and support levels.

The BNB/USD pair is trading around the $310 level, down 0.99%. The volatility is quite low, and the pair has been unable to break past the $314 resistance. The 20 EMA also confirms the bearish trend, as it is trading below this level. The bullish and bearish divergence has kept the pair in a sideways movement.

However, the XRP/USD pair shows some signs of strength as it is trading around the $0.4642 level and is up 1.17 percent. The bulls are gradually pushing the prices higher but have not yet been able to break past the $0.4651 resistance. If the buyers manage this, then XRP could go up toward its previous highs near the $0.4700 level.

Cardano, Solana, and other altcoins also seem to be in the grip of the bears. ADA/USD is trading around $0.3751, down by 0.90%. The pair has been making lower and lower highs, suggesting that the sellers are still dominating this market. Similarly, SOL/USD is trading 2.57% lower at the $20.47 level and has failed to break past the resistance of the $22.00 level.

Overall, today’s price analysis shows that most of the major cryptocurrencies are trading in the red zone and are not able to make any significant progress. The selling pressure is keeping them suppressed near their support levels. The buyers should now look to break past the key resistances in order to make some gains.

Recommended For You: