- Last month, Animoca Brands emerged as the top investor in crypto fundraising.

- The total funds raised in the crypto space hit a 2-year-high in October 2024.

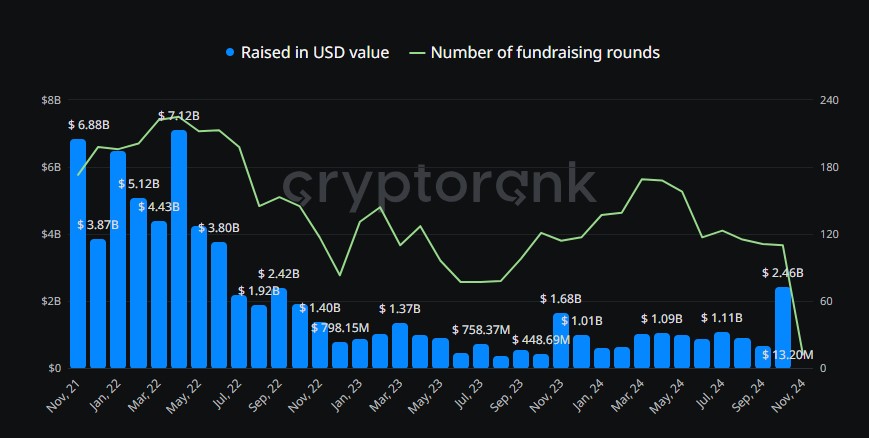

Months after the Terra Luna collapse in Q2 2022, the pace of crypto fundraising slowed, falling below $3 billion—a level it has yet to regain. October 2024, however, marked a bullish trend by reaching a 28-month peak with $2.45 billion in total fundraising.

According to CryptoRank, total fundraising last month climbed by over 264.4% from September’s $672.27 million. There was a slight drop — 1.8% — in VC rounds, falling from 111 to 109. From January to October, the crypto space saw total fundraising exceed $8.08 billion.

Of the different verticals, blockchain services dominated fundraising with $1.25 billion. The social sector came next, raising $578.15 million, followed by blockchain infrastructure at $265.3 million, DeFi at $143.2 million, and GameFi at $102.85 million.

Animoca Brands and Polygon Co-Founder In Lead

Hong Kong-based Web3 VC giant Animoca Brands took the lead in the Uptober rally of the crypto fundraising arena with 9 deals. In addition to web3 gaming and DeFi, the company allocated funds to emerging narratives like DePIN and AI.

October Venture: Animoca led all firms with 9 deals, followed by CMS (7) and Hack VC (6).

— Messari (@MessariCrypto) November 4, 2024

Historically targeting Gaming and Collectibles, Animoca diversified into DeFi, DePIN, AI, and more this month.@ekrahm and @0xMert_ led angels with 5, ranking T4th. pic.twitter.com/3oUKj9mETq

Among October’s top 10 record makers stood two angel investors — Ekram Ahmed, Head of Marketing and Comms. of Celestia, and Mert Mumtaz, Helius Labs CEO. Both these investors carried out 5 deals in the month.

Remarkably, Animoca Brands stands at the top of the all-time list of investors, taking the first spot with 435 rounds. Meanwhile, Coinbase Ventures takes the second spot, boasting 416 funding rounds primarily in the exchange niche.

Outlier Ventures comes in third, having made 326 investments in projects focused on developer tooling. Binance Labs follows with 308 investments, primarily in gaming, while NGC Ventures rounds out the list with 277 investments mainly in the exchange niche.

On another note, Sandeep Nailwal, co-founder of Polygon, is reported by Messari as the top angel investor with 41 investments. Popular NFT investor Santiago R Santo, aka CryptoPunk 9159, holds the second position with 39 funding rounds. Notably, Solana co-founder Anatoly Yakovenko ranks fourth with 30 rounds, while Helius Labs CEO Mert Mumtaz occupies the sixth spot with 22 rounds.

Here are some key events and facts to know about crypto fundraising in 2024:

- In June 2024, crypto exchange Bitstamp was acquired by trading platform Robinhood for $200 million. This is the largest merger & acquisition (M&A) to date.

- In July 2024, Blockchain-led AI startup Sentient raised $85 million in seed round, co-led by Peter Thiel’s VC firm Founders Fund.

- In August, IP-focused blockchain Story Protocol recorded $80 million in a Series B round led by Andreessen Horowitz (a16z).

- The United States has emerged as the leading jurisdiction in fundraising, with over $3.08 billion raised across 180 rounds.