- Amber intends to seek a license to operate a virtual asset trading platform in Hong Kong.

- The crypto firm allegedly had to lay off more than 40% of its workforce post-FTX collapse.

As part of its strategy to shift its emphasis from retail to institutional clients, Bloomberg reports that Singapore’s Amber Group is contemplating selling its Japanese operation. Annabelle Huang, the managing partner at Amber, said the company is exploring alternatives, including a sale, for its Japan division. A “very high quality market,” Huang said of Japan, “but regulations are strict.”

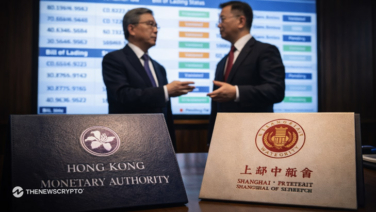

Meanwhile, Amber intends to seek a license to operate a virtual asset trading platform in Hong Kong. As the SAR is making strides toward becoming a digital-asset center. According to Huang, the regulatory climate in Hong Kong has been quite positive for the company.

Automatically Inclined Toward Hong Kong

In contrast to Singapore, which has been tightening controls on cryptocurrencies, particularly for retail investors. Hong Kong hopes to adopt virtual-asset legislation that would foster development and safeguard investors. Huang elaborated, saying that although Hong Kong is “sort of leading the way” at the moment, Singapore is “not exactly closing the door” either.

Amber Group’s Series C fundraising round, headed by Fenbushi Capital and totaling $300 million, closed in December 2022. After Amber’s prior Series B fundraising was put on hold due to the failure of FTX, the company ultimately decided to go forward with a Series C round of funding.

Amber was working on extending its Series B to raise $100 million at a $3 billion value before FTX collapsed. As a result of the aftermath of FTX, Amber Group allegedly had to lay off more than 40% of its workforce.

Moreover, crypto firms are automatically inclined towards Hong Kong amid regulatory uncertainty across the globe regarding the sector.