- The Digital Chamber calls for a review of ongoing crypto-related lawsuits and investigations under the SEC.

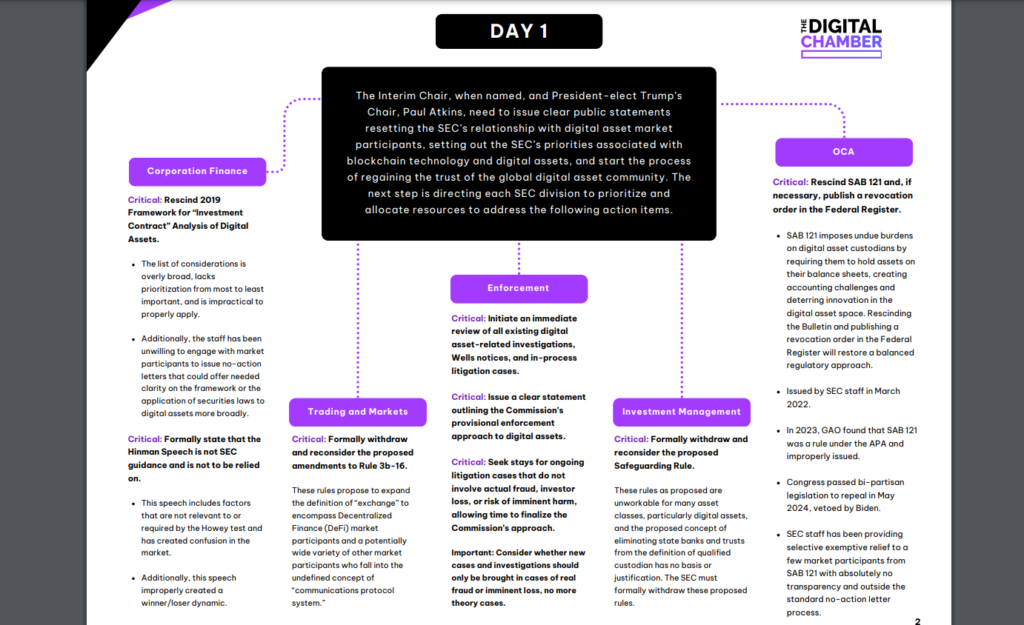

- It urges the SEC to repeal the 2019 Howey test framework and the controversial “Hinman Speech.”

- The group advocates for clearer crypto regulations and the repeal of burdensome rules like SAB 121 to support innovation.

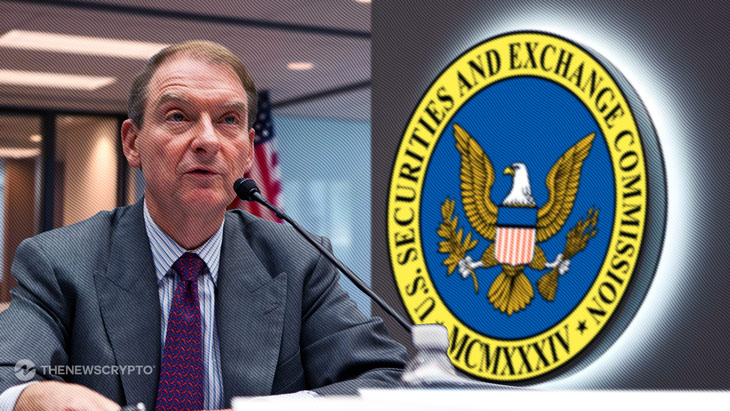

Digital Chamber Urges SEC to Rethink

The Digital Chamber, a prominent crypto advocacy group, urges the U.S. Securities. Exchange Commission (SEC) to reconsider its ongoing crypto-related investigations, Wells notices, and lawsuits from the first day of the incoming Trump administration.

This call is part of a strategy to repair the SEC’s strained relationship with the crypto industry and foster mutual trust between regulators and digital asset businesses. The group believes that most players in the crypto space are working responsibly. The SEC should recognize this to create a more transparent and supportive regulatory environment.

The Digital Chamber’s Token Alliance, has ties to Paul Atkins Trump’s nominee for SEC Chair. Which proposes a fresh approach to regulating the crypto sector. Under its current leadership, it has engaged in legal disputes with industry giants like Binance, Coinbase, and Ripple. By creating friction between the regulator and crypto firms.

Key Priorities for the SEC in the First 90 Days

The group argues that these ongoing cases should be reviewed and, in some instances, paused. This would give the SEC time to refine its regulatory approach, ensuring it fosters innovation rather than hindering it.

In its agenda, the Digital Chamber outlines several key priorities for the SEC during the first 90 days of the new administration.

One of the most significant proposals is to halt litigation in cases that do not involve fraud, investor harm, or immediate risk. This would help the SEC reassess its strategy and reduce unnecessary legal burdens on the industry. Additionally, the group calls for the SEC to repeal the 2019 framework on the Howey test. Which determines whether digital assets are securities.

The Digital Chamber argues that the framework has led to confusion and has not kept pace with the evolving crypto space. The controversial “Hinman Speech” that relied on the framework to assess digital assets should be discarded, as it has created an unfair and divisive dynamic between regulators and the crypto community.

Another issue the Digital Chamber highlights is the SEC’s Staff Accounting Bulletin 121 (SAB 121). Which requires companies that custody cryptocurrencies to treat them as liabilities on their balance sheets. The group argues this rule is overly burdensome and could push investors to riskier offshore solutions.

They also suggest that the SEC reconsider its plans to expand the definition of “exchanges” to include decentralized finance (DeFi) platforms. Which could stifle innovation in the sector.

The Future of Crypto Regulation

The Digital Chamber’s proposal reflects a desire for clearer, more predictable crypto regulations to encourage innovation and rebuild trust in the SEC. With Paul Atkins poised to lead the SEC, the crypto industry hopes the new leadership will adopt a more balanced and transparent approach.

The next 90 days will be critical. Determining whether the SEC can reset its relationship with the crypto community and create an environment.

Highlighted Crypto News Today

Can BabyDoge Regain Its Bullish Trend with Puppy.fun Launchpad?