- Coinbase filed its rulemaking petition on July 22, 2022, and faced rejection on July 27, 2023.

- Judges label SEC’s response as “vacuous,” demanding clearer regulatory guidance.

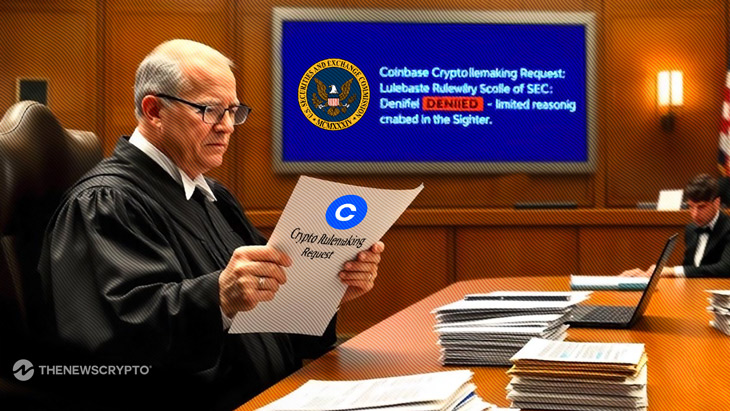

In a recent court hearing, judges expressed skepticism regarding the SEC’s denial of Coinbase’s petition for rulemaking. Coinbase filed this petition on July 22, 2022, seeking clarity on regulatory guidelines. The SEC officially rejected the petition on July 27, 2023, claiming that it had already established sufficient guidelines.

This case addresses the regulation of cryptocurrencies. It has garnered significant attention, with the Third Circuit Court labeling the SEC’s rationale as “vacuous.” This critique raises important concerns about the SEC’s approach to crypto regulation.

Today @coinbase made oral arguments before the Third Circuit in our case against @SECgov’s repeated arbitrary and capricious denial of our petition for rulemaking, which we originally put forward over 2 years ago. Here’s the original petition: https://t.co/k0n2wwaBU9 1/5

— paulgrewal.eth (@iampaulgrewal) September 23, 2024

Coinbase, a leading cryptocurrency exchange, argues that existing rules are unclear and outdated. As a result, the lack of comprehensive regulations stifles innovation in the crypto industry. The judges challenged the SEC’s assertion, asking the agency to clarify its reasoning for denying the petition.

Judges Challenge SEC’s Stance on Coinbase’s Regulatory Petition

SEC lawyer Ezekiel Hill emphasized,

“If Coinbase wants to arrange its business in a way that does not comply with the existing regulatory framework, that does not establish a right to have the framework adapted to meet their business.”

Judge Ambro was also confused by the SEC’s position, stating,

“It’s a brief reasoning, but I don’t see the reasoning.”

Furthermore, Judge Stephanos Bibas pointed out that the SEC has launched numerous enforcement actions against crypto firms, noting,

“It’s not that the agency isn’t interested in the area; it’s just interested in picking off wrongs without giving higher-level guidance.”

Moreover, the judges highlighted the need for more transparent communication from the SEC. They indicated that the agency’s refusal to engage with Coinbase’s request could hinder the industry’s growth. Without clear regulations, market participants are left in uncertainty, leading to adverse effects on innovation and consumer protection.

Furthermore, the outcome of this case could set a precedent for future regulatory actions. If the court rules in favor of Coinbase, it may compel the SEC to revisit its approach to crypto regulation. This ruling could usher in a new era of clarity and stability for the cryptocurrency market.

Highlighted Crypto News Today

Bybit Launches First Shariah-Compliant Crypto Islamic Account