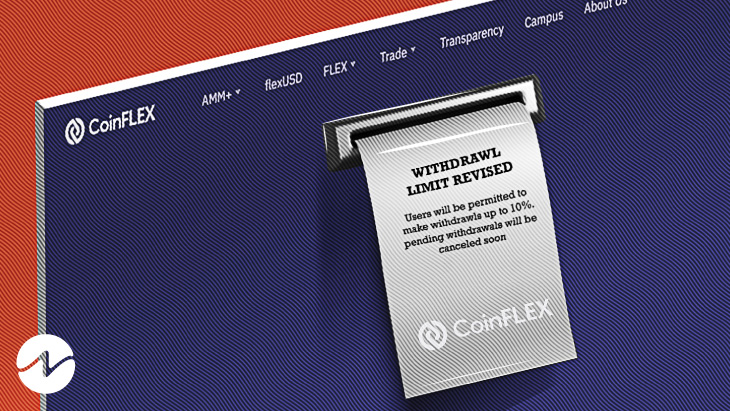

- The platform’s stablecoin, flexUSD, will remain unavailable until further notice.

- Earlier this month, the platform put a hold on withdrawals.

In the wake of a conflict with notable crypto investor Roger Ver “Bitcoin Jesus”, the trading platform CoinFLEX has announced limited client withdrawals. Users may now withdraw 10% of their cash, according to a business blog post published on Thursday, but the platform’s stablecoin, flexUSD, will remain unavailable until further notice.

Customers Suffering Between the Tussle

To recoup $84 million in damages, CoinFLEX said last week that it was taking legal action against one “large individual customer” in Hong Kong. Roger Ver, a well-known Bitcoin advocate and angel investor, was previously named by the firm, although he wasn’t included in the arbitration statement.

Earlier this month, the platform put a hold on withdrawals, following a long list of enterprises that have been hit hard by a bear market and dubious business practices. To put it another way, CoinFLEX believes that Bitcoin Cash proponent and early Bitcoin investor Roger Ver owes them $47 million in unpaid debts.

Since Ver has failed to honor his commitment to pay back CoinFLEX money he owes in the form of the USDC stablecoin, Mark Lamb, CEO of CoinFLEX, says the platform is having trouble processing withdrawals. Ver alleges that CoinFLEX owes him money, which Lamb also disputes, despite Ver’s denial of the charge.

For years, Ver was referred to as “Bitcoin Jesus” because he preached the gospel of bitcoin and invested in early bitcoin firms. After that, a hard fork occurred, resulting in the emergence of Bitcoin Cash, a new cryptocurrency based on the Bitcoin blockchain. Former CEO of Bitcoin.com, Ver now prefers Bitcoin Cash over the original Bitcoin.

Recommended For You: