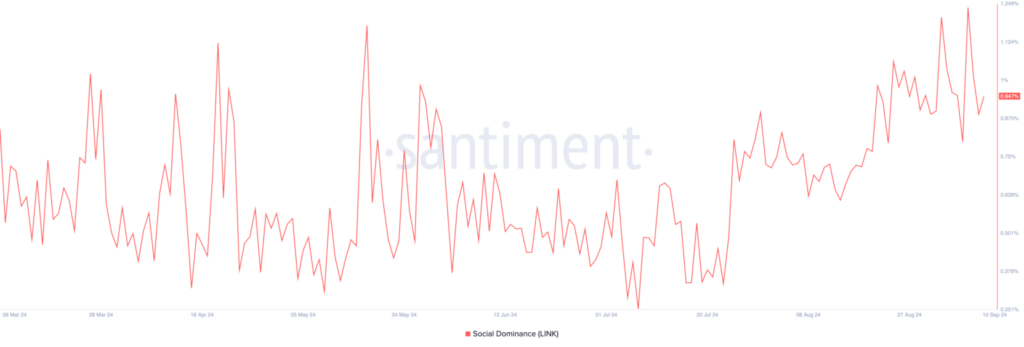

- LINK’s social dominance spikes to highest level since December 2023.

- Number of LINK holders decreases amid price decline since August 26.

- Bearish divergence on price chart suggests potential drop to $8.08, with $11.24 as bullish target.

Chainlink (LINK) has captured the crypto community’s attention, as evidenced by a surge in its social dominance metric. However, this increased buzz comes against a backdrop of weakening buying pressure, creating a complex market narrative that challenges simple bullish or bearish categorizations.

On-chain data from Santiment reveals that LINK’s social dominance peaked at 1.24 on September 7, marking its highest level since December 2023. This metric, which measures an asset’s share of online discussions relative to the top 100 cryptocurrencies, indicates a surge in Chainlink-related conversations within the broader crypto discourse.

Paradoxically, this spike in social interest coincides with a decline in the number of addresses holding LINK tokens. The altcoin’s price has experienced a 16% drop since August 26, prompting some holders to liquidate their positions.

Consequently, the total number of LINK-holding addresses has dwindled to 722,000, continuing a downward trend that began on August 11.

Chainlink price shows conflicting picture

Currently trading at $10.47, LINK’s price action presents a conflicting technical picture. While some analysts interpret the combination of high social dominance and decreasing holder count as potentially bullish in a stabilizing market, a bearish divergence on the price chart suggests caution.

The Chaikin Money Flow (CMF) indicator has been trending downward despite recent price increases, signaling a bearish divergence. This discrepancy between price movement and underlying money flow suggests that buying pressure may be waning, potentially setting the stage for a price correction.

Looking ahead, if LINK fails to maintain its current uptrend, it could retest the $10.25 support level. A breach of this threshold might pave the way for a more significant decline, potentially driving the price towards the $8.08 mark.