- Chainlink (LINK) price is facing difficulties in surpassing the crucial psychological resistance level of $15.

- The integration of Chainlink’s Proof of Reserve (PoR) with 21Shares’ Ethereum ETFs had minimal impact on the price.

- LINK is currently trading in the $13 range and a breach above this level could enable further recovery.

Chainlink (LINK), the decentralized oracle network, is currently grappling with the challenge of breaking above the critical psychological resistance level of $15.

This struggle persists despite the prevailing optimism among LINK holders, which is particularly surprising given the current market conditions.

Chainlink’s Major News Fails to Ignite Price Action

The recent integration of Chainlink’s Proof of Reserve (PoR) with 21Shares’ Ethereum ETFs, aimed at enhancing transparency, was met with positive feedback from the community. However, this development had a minimal impact on Chainlink’s price, which remained largely unaffected by the news.

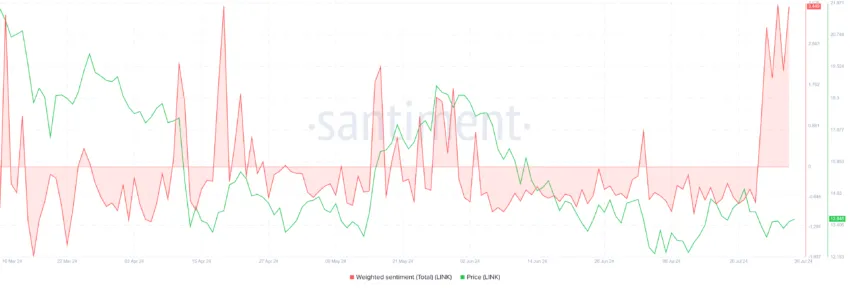

The weighted sentiment, a metric that combines and analyzes all the mentions and expressions related to a topic, substantiates this positive feedback.

This data helps provide a more nuanced view of public opinion or investor sentiment, with upticks suggesting bullishness and downticks hinting at bearishness.

Despite the currently high optimism, investors’ actions are not aligned with their sentiment, as evidenced by the declining participation of LINK holders.

The daily average number of investors conducting a transaction on the Chainlink network has been steadily decreasing, currently hovering around 2,000.

This figure represents a decline from the average of 3,840 recorded at the beginning of the month, indicating that LINK holders are not finding sufficient incentive to participate due to the recent lack of profits.