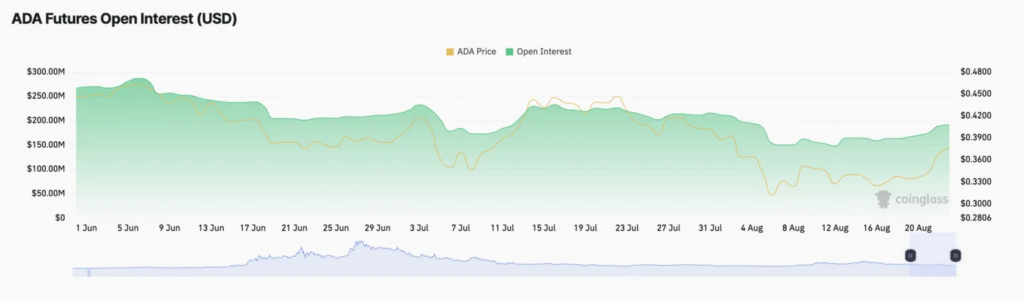

- ADA rebounds to $0.37 after August 5 market sell-off.

- Futures open interest up 21%, reaching $191 million with positive funding rates.

- Technical indicators suggest potential for further gains, with $0.40 as next target.

Cardano (ADA) has demonstrated remarkable resilience in the wake of a market downturn, staging a compelling recovery from its August 5 low of $0.27. This rebound has seen ADA’s price surge to reach $0.37.

The recent price action has been accompanied by a notable increase in futures market activity. Data from Coinglass reveals a 21% surge in ADA’s futures open interest over the past week, now totaling $191 million.

This metric, which tracks the total value of outstanding futures contracts, signals growing engagement from traders and potentially heightened market liquidity.

Adding to the bullish narrative, funding rates for ADA futures have remained predominantly positive over the past seven days. The current funding rate of 0.0067% suggests that long positions are in higher demand, reflecting a generally optimistic outlook among traders regarding ADA’s price trajectory.

This positive sentiment in the derivatives market often serves as a leading indicator for potential price appreciation in the spot market.

On-chain metrics support Cardano’s bullish case

On-chain metrics further support the bullish case for Cardano. The daily ratio of transaction volume in profit to loss currently stands at 1.11, indicating that for every losing transaction, 1.11 transactions are resulting in profit.

This favorable ratio underscores the profitability of recent trading activity and may contribute to sustained buying pressure.

Technical analysis of Cardano’s one-day chart reveals encouraging momentum indicators. The Chaikin Money Flow (CMF) registers a positive value of 0.11, signaling increased capital inflow into the ADA market.

Typically, a CMF reading above zero is interpreted as a sign of strong buying pressure, lending credence to the sustainability of the current rally.

Complementing the CMF, ADA’s Relative Strength Index (RSI) stands at 58.24, indicating that buying activity currently outweighs selling pressure without yet reaching overbought territory. Should this trend persist, Cardano appears well-positioned to challenge its two-month high of $0.40.