- ADA falls from Q1 high of $0.80, struggling to reclaim momentum.

- Supply wall of 2 billion ADA at $1.04 creates significant resistance.

- Price targets: potential drop to $0.32, or rise to $0.61 if Bitcoin surges.

Cardano’s promising start to 2024, which saw ADA surge from $0.46 to $0.80 in the first quarter, has given way to a prolonged decline. This reversal of fortune has left investors questioning whether ADA can recapture its early-year momentum or revisit its 2022 price levels.

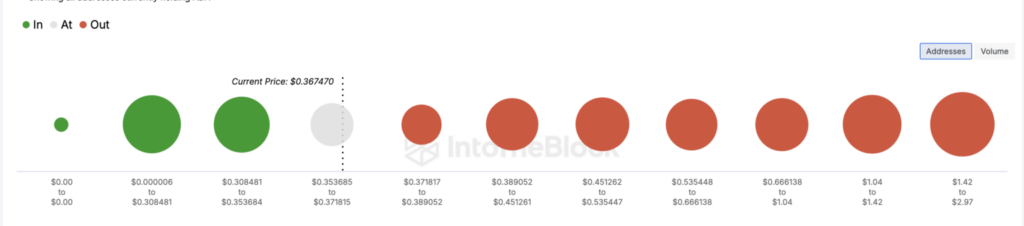

A key obstacle to ADA’s price recovery lies in the substantial supply wall at $1.04, where over 1 million addresses hold more than 2 billion ADA tokens. The Global In/Out of Money (GIOM) metric reveals this concentration of holdings creates formidable resistance, potentially capping upward price movement.

While shorter-term targets around $0.66 appear achievable, breaking through the $1.04 level presents a significant challenge.

MDIA provides further Cardano market dynamics

The Mean Dollar Invested Age (MDIA) indicator provides additional insight into ADA’s market dynamics. The 90-day MDIA shows a consistent upward trend, suggesting that long-term holders are maintaining their positions rather than actively trading.

This stagnation in investor activity typically makes sustained price appreciation more difficult to achieve.

Technical analysis of ADA’s daily chart reveals a concerning head-and-shoulders pattern, traditionally interpreted as a bearish reversal signal. Currently trading at $0.37, Cardano faces immediate resistance that could trigger a decline towards $0.32 if current market conditions persist.

However, Cardano’s longer-term prospects remain tied to broader market conditions, particularly Bitcoin’s performance. A BTC breakthrough above $70,000 could catalyze an ADA rally towards $0.61, with potential for further gains if Bitcoin establishes new all-time highs.