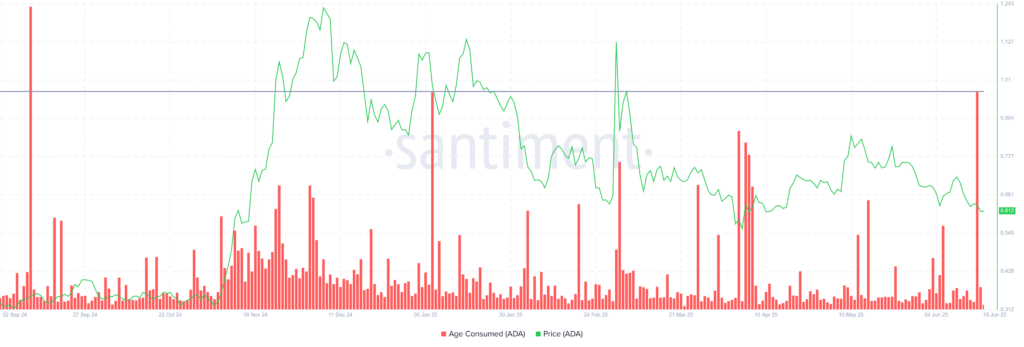

- Cardano’s “age consumed” indicator reaches a nine-month high

- The Chaikin Money Flow Index remains below zero, indicating weak investor inflows.

- ADA trades at $0.61 above important $0.60 support, with a possible dip to $0.57.

Cardano has surrendered recent gains through a sharp decline that has prompted long-term holders to liquidate positions, creating additional selling pressure that threatens the cryptocurrency’s price stability.

The exodus of patient investors, typically viewed as a stabilizing force during market volatility, has raised concerns about ADA’s ability to maintain current support levels amid broader market weakness.

The “age consumed” metric has spiked to its highest level in nine months, indicating that coins held for extended periods are being moved and likely sold. This metric tracks the movement of previously dormant tokens, with increases suggesting that long-term holders are losing conviction and choosing to realize losses rather than continue holding through the current downturn.

ADA Weak Inflows Compound Selling Pressure Challenges

The behavior of long-term holders carries particular weight in determining price direction, as these investors typically provide stability during market corrections. Their decision to sell creates a dual impact: removing potential buying support while adding to circulating supply available for sale. This dynamic makes recovery more difficult as the market must absorb additional selling pressure.

Chaikin Money Flow indicator readings below zero confirm weak investor inflows, preventing any meaningful price recovery despite the ongoing sell-off. The CMF measures accumulation and distribution patterns, with negative readings indicating that money is flowing out of the asset rather than entering. This lack of new capital compounds the challenges created by long-term holder selling.

The combination of increased selling from patient investors and reduced inflows creates a challenging environment for price stability. Without fresh capital to offset selling pressure, Cardano faces difficulty maintaining current price levels, let alone generating upward movement toward previous highs.

Cardano currently trades at $0.61 after declining 14.6% over the past seven days, holding above the critical $0.60 support level that has become the focal point for determining near-term direction. This support zone has provided temporary stability, but continued selling pressure could overwhelm buying interest at this level.

A break below $0.60 would likely trigger additional selling as stop-loss orders activate and momentum traders join the downward move. The next key support sits at $0.57, representing a potential target if current support fails to hold. Such a decline would compound investor losses and likely intensify bearish sentiment surrounding the cryptocurrency.