- Cardano surges 35% to seven-month high at $0.63 before retracing.

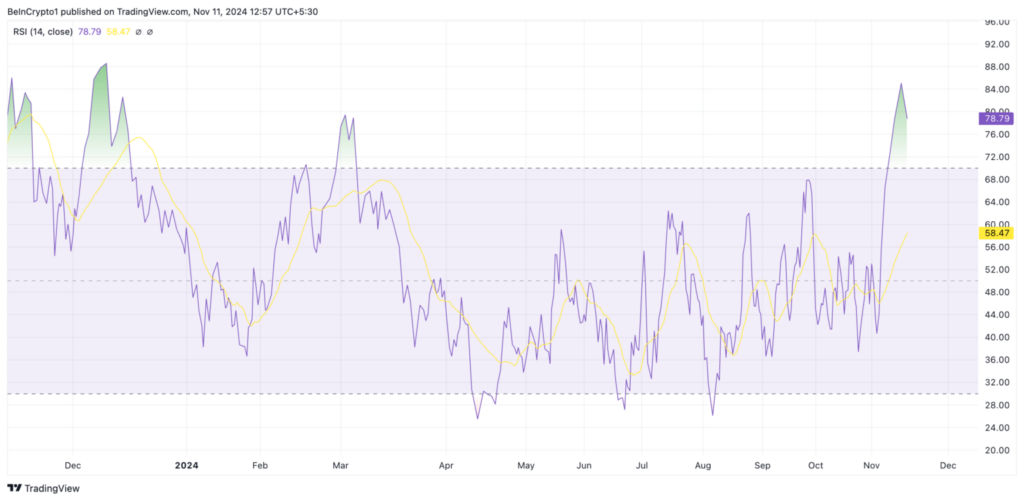

- RSI reaches 78.79, highest since December 2023, indicating overbought conditions

- Political catalyst emerges as Hoskinson announces potential Trump administration involvement

Cardano demonstrates significant price volatility following founder Charles Hoskinson’s announcement regarding potential involvement in future US crypto policy development.

The market reaction triggers technical warnings as price discovery continues at elevated levels.

Cardano shows overextended market conditions

Multiple technical indicators suggest overextended market conditions as ADA trades beyond traditional boundaries.

The Relative Strength Index registers 78.79, significantly above the standard overbought threshold of 70, while price action extends beyond the upper Bollinger Band, traditionally signaling potential reversal zones.

Recent price movement shows ADA testing critical resistance at $0.60, representing a level unseen since April’s trading sessions.

This dramatic appreciation follows Hoskinson’s November 9 announcement regarding potential collaboration with Washington lawmakers on cryptocurrency policy initiatives.

Cardano investors now focus on key support levels at $0.54 and $0.40, representing potential stabilization points should current overbought conditions trigger profit-taking activity. However, sustained momentum above $0.60 could drive prices toward the year’s high of $0.81.

The convergence of political catalysts and technical warnings creates an intriguing market dynamic for ADA’s short-term prospects.

These factors suggest careful monitoring of Cardano volume patterns and price action remains crucial for confirming sustained strength or potential reversals.

Trading activity around these critical levels will likely determine ADA’s ability to maintain recent gains, as market participants balance fundamental developments against technical indicators suggesting overextended conditions.