- ADA fails to break out of bullish descending wedge due to changing market conditions.

- Investor bullishness diminishing as large wallet holder activity drops 32% in a month.

- Price could drop to $0.31 or potentially rally to $0.53 if breakout occurs.

Cardano (ADA) finds itself at a critical juncture as its anticipated breakout from a bullish descending wedge pattern faces unexpected hurdles. The cryptocurrency’s recent price action has diverged from investor expectations, potentially delaying or even invalidating the forecasted upward movement.

The past week saw ADA poised for a major move, with technical indicators suggesting an imminent breach of the descending wedge formation.

However, rapidly shifting market conditions have thwarted this potential breakout, leaving investors in a state of uncertainty. This failure to capitalize on favorable technical setups has begun to erode the bullish sentiment that previously surrounded Cardano.

Investor confidence in Cardano plunges

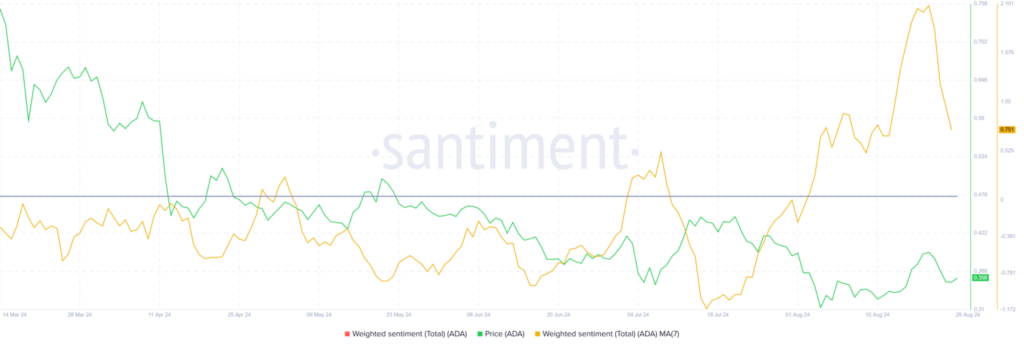

Investor confidence in ADA has taken a notable hit as the cryptocurrency repeatedly fails to break out during key market rallies. These missed opportunities have led to a gradual but significant decline in optimism among ADA holders.

As this pattern of failed breakouts persists, it could potentially exacerbate existing bearish trends, creating a self-fulfilling cycle of downward pressure on the price.

Further compounding ADA’s challenges is the marked decrease in activity among large wallet holders, often referred to as crypto whales. Over the past month, transaction volume from these influential market participants has plummeted by 32%, falling from $7.81 billion to $5.26 billion.

This substantial reduction in whale activity signals waning interest from major investors, potentially foreshadowing further downside for ADA’s price.

Currently trading at $0.36, ADA faces the risk of failing to break out of the descending wedge pattern that has been governing its price action. While a successful breakout could theoretically trigger a 47% rally towards $0.53, the diminishing investor optimism casts doubt on this bullish scenario.

Instead, ADA may find itself constrained below the upper trendline of the pattern, leaving it vulnerable to a potential drop towards the $0.31 support level.