- Cardano has dropped 22% in four days, but indicators suggest a potential bullish reversal.

- MVRV Ratio at -21.81% places ADA in the accumulation zone, historically leading to price rebounds.

- Chaikin Money Flow (CMF) rising, showing strong investor interest and capital inflows.

Cardano (ADA) has faced a price drop, falling 22% over the past four days. While this decline might seem bearish, on-chain data and technical indicators suggest it could be an opportunity for long-term investors. Historical trends indicate that such drops often precede major recoveries, and ADA may be nearing a reversal point.

Cardano Investors Have a Shot at Accumulation

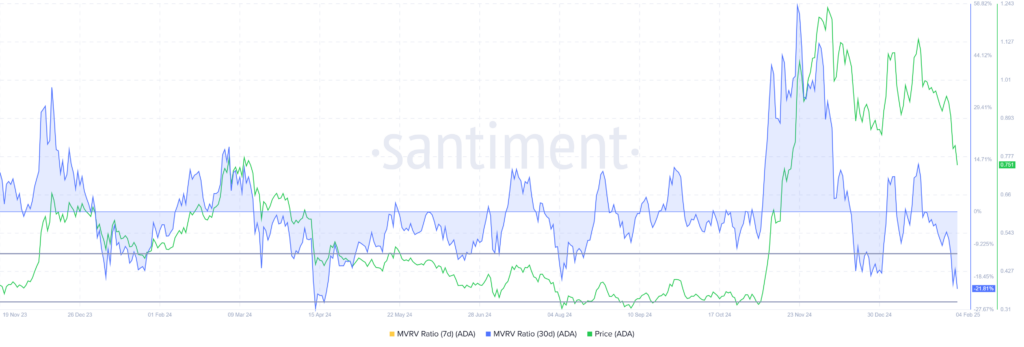

The Market Value to Realized Value (MVRV) Ratio currently stands at -21.81%, putting ADA firmly in the “opportunity zone”, which ranges between -11% and -25%. This metric historically signals strong price rebounds, as it indicates undervaluation and increased investor accumulation.

Previous instances of ADA dipping into this range have led to substantial price recoveries. As prices stabilize, investor sentiment remains positive, reducing the risk of a prolonged downturn.

Additionally, the Chaikin Money Flow (CMF) indicator has spiked, signaling strong inflows and increased buying pressure. The CMF measures the volume-weighted average of accumulation and distribution, and its recent uptick suggests that investors are actively accumulating ADA at discounted prices.

This combination of low MVRV and rising CMF reinforces the likelihood of a price bounce, increasing ADA’s upside potential in the coming weeks.

ADA Price Prediction: Breakout Incoming?

Cardano is currently trading within a broadening descending wedge—a pattern that often precedes bullish breakouts. Based on historical trends, ADA could see a 45% surge, bringing the price up to $1.05.

If ADA successfully breaks the $1.05 resistance, it could accelerate towards $1.32, marking the beginning of a new bullish phase. However, in the short term, reclaiming $0.99 as support is crucial for confirming a strong recovery.

The bullish thesis would only be invalidated if ADA loses support at $0.70. A drop below this level could push prices to $0.62, signaling a deeper downtrend. Maintaining support above $0.70 is critical for Cardano’s continued bullish trajectory.