- ADA price up 10% in past week, eyeing another 10% gain.

- Trading in horizontal channel between $0.31 and $0.40 since August 1.

- Technical indicators suggest bullish momentum, but $0.40 resistance crucial.

Cardano (ADA) has had a decent 10% price surge over the past week. This upward movement has positioned ADA on the cusp of a potential breakout, with market participants closely watching for signs of another 10% gain that could propel the token beyond the key resistance level at $0.40.

Since August 1, ADA has been confined within a horizontal channel, oscillating between a well-defined support at $0.31 and resistance at $0.40. This technical pattern has created a narrow trading range, with recent price action pushing ADA towards the upper boundary of this channel.

The Relative Strength Index (RSI) lends credence to the bullish narrative, currently registering at 57.25. This reading suggests growing momentum as market participants increase their ADA accumulation. The RSI’s position above the midpoint of 50 indicates that buying pressure is outpacing selling pressure, potentially setting the stage for further upside.

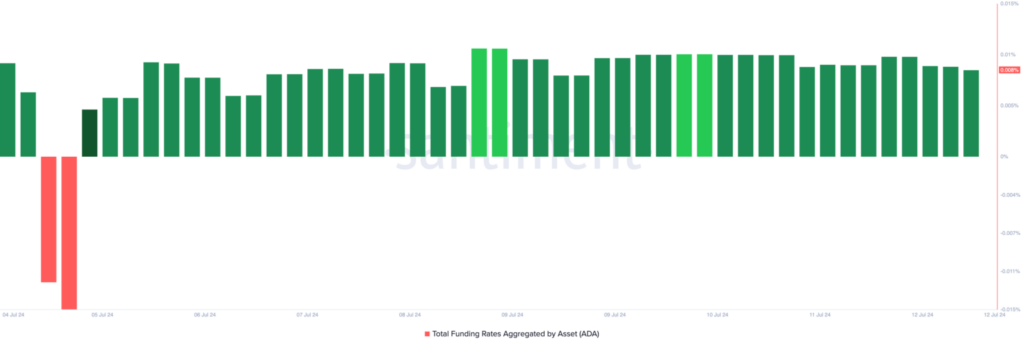

ADA’s funding rate stands positive

Further bolstering the optimistic outlook, Cardano’s funding rate stands at a positive 0.008%. This metric, which reflects the cost of holding leveraged positions, suggests that traders are willing to pay a premium to maintain long positions. Such behavior often precedes price rallies, as it indicates widespread anticipation of upward movement.

The Elder-Ray Index’s bull-bear power, currently at 0.02, adds another layer of bullish confirmation. This positive reading indicates that buying pressure is dominating selling activity, reinforcing the narrative of growing demand for ADA.

As ADA approaches the critical $0.40 resistance level, market participants are keenly aware of the significance of this potential breakout.

Since entering the current horizontal channel, ADA has only made one unsuccessful attempt to breach this threshold. A successful breakout this time could pave the way for a rally towards $0.47, a price point not seen since June.