- Solana price is up in 24 hours and 21% over the past week, with a market cap nearing $130 billion.

- Technical indicators like Ichimoku Cloud and BBTrend suggest bullish momentum but hint at potential consolidation.

- Key levels to watch: resistance at $292 and $300; support at $229, $211, and $192.

Solana (SOL) has seen a strong rally, climbing in the past 24 hours and 21% over the week. Its market cap now approaches $130 billion, surpassing notable companies like Sony and Dior. Trading volume has surged nearly 19% in the last day, reaching $10 billion and reflecting heightened market activity.

While bullish indicators show strength, signs of consolidation suggest a possible pause in momentum. Traders are closely watching if SOL can test resistance at $292 and potentially cross the $300 milestone for the first time.

SOL Ichimoku Cloud Signals Bullish Momentum

The Ichimoku Cloud analysis for Solana reveals a positive setup, with the price trading above the cloud—a bullish indicator. The Tenkan-sen (blue line) remains above the Kijun-sen (red line), highlighting short-term upward momentum.

Additionally, the leading green cloud (Senkou Span A above Senkou Span B) confirms a favorable trend. However, the lack of steep upward angles on the Tenkan-sen and Kijun-sen suggests consolidation may be underway.

A breakout above $270 would signal renewed bullish momentum, potentially paving the way for SOL to test resistance at $292 and aim for $300. Conversely, a dip back into the cloud could indicate weakening momentum, with the lower boundary serving as a critical support zone.

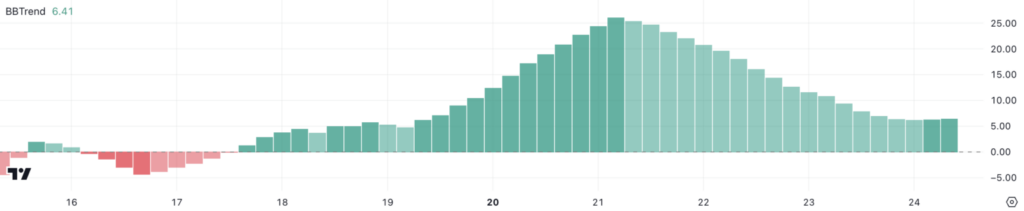

SOL BBTrend Indicates Consolidation

Solana’s BBTrend (Bollinger Band Trend) currently stands at 6.41, down from its recent peak of 26 just three days ago. Despite the decline, the positive value indicates upward momentum, though it has weakened.

BBTrend measures trend strength based on price interaction with Bollinger Bands. While stabilization at 6.41 suggests the decline in momentum has paused, it also signals that the trend is not as strong as before. This could point to consolidation, allowing traders to anticipate the next major move.

If Solana regains strong momentum, it could test its previous all-time high of $292 and push further to $295. Breaking these levels would bring $300 into focus—a milestone that could attract additional bullish interest and market activity.

Key resistance levels include $292, $295, and the psychological $300 mark. A sustained move above these could drive further price appreciation.

On the downside, if momentum cools, SOL may test support at $229. A breakdown below this level could expose the next support at $211, with deeper retracement possible at $192 if bearish pressure intensifies.