- Due to financial system restrictions, infrastructural constraints, or geographic location, millions of people still lack access to dependable banking.

- MyBank, Bybit’s new retail banking layer, is a key component of this effort and is scheduled to debut in February 2026.

- More than 2,000 institutions now utilize Bybit’s infrastructure – a 100% year-over-year growth — showing increased demand for hybrid financial platforms that integrate conventional and digital asset ecosystems.

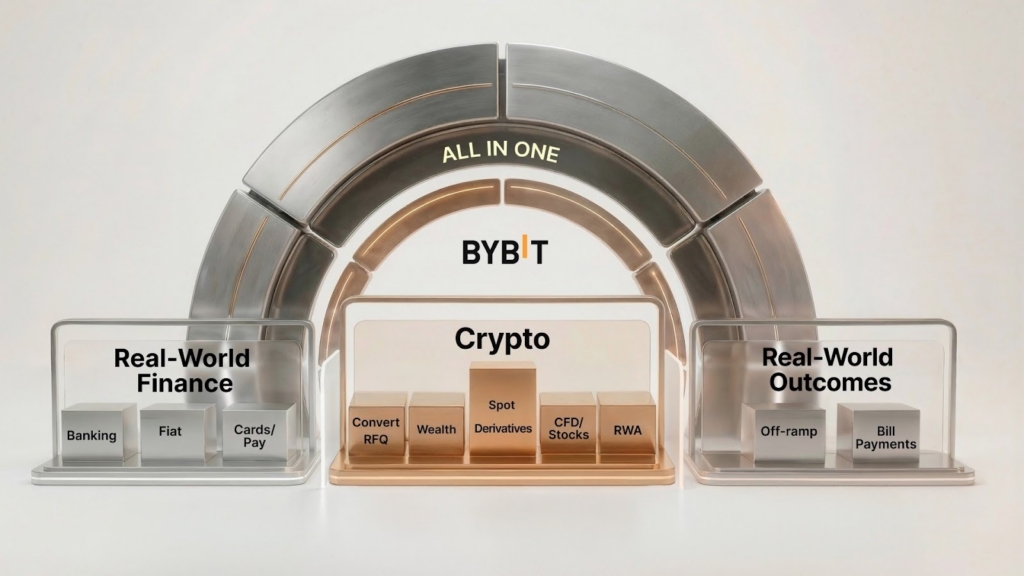

Bybit, the second-biggest cryptocurrency exchange in the world based on trading volume, stated today that it will evolve into “The New Financial Platform” in 2026. This global financial ecosystem aims to provide underserved people more access to contemporary banking, investing, and payment infrastructure. During the biannual keynote address, co-founder and CEO Ben Zhou presented the company’s mission, which aims to transform it from its beginnings as a cryptocurrency exchange into a single financial platform that links conventional markets, cryptocurrencies, and real-world financial services.

At the core of the approach is a long-term mission: empowering the 1.4 billion underbanked people worldwide by lowering obstacles to participation in contemporary finance.

Due to financial system restrictions, infrastructural constraints, or geographic location, millions of people still lack access to dependable banking. Bybit’s platform design harnesses blockchain technology to enable always-on, borderless financial services that connect seamlessly with regulated fiat infrastructure.

“Finance should not be limited by geography,” said Ben Zhou, co-founder and CEO of Bybit. “We are building financial infrastructure that connects crypto utilities with real-world economic activity. Our mission is to remove the boundaries that are inconvenient for people from modern finance and create a system that is always accessible, efficient, and global by design.”

MyBank: Retail Banking Without Borders

MyBank, Bybit’s new retail banking layer, is a key component of this effort and is scheduled to debut in February 2026. MyBank offers specialized accounts that facilitate regular cross-border financial transactions while streamlining high-value fiat on- and off-ramps while adhering to regulatory standards.

The service is meant to solve real-world challenges experienced by customers in developing markets: delayed transfers, restricted access, excessive fees, and limited offerings. For people and companies with bank-grade expertise, MyBank’s integration of cryptocurrency liquidity with banking rails allows for quicker and more economical capital usage.

ByCustody: Institutional-Grade Asset Protection

Financial inclusion demands trust. ByCustody, Bybit’s institutional custody framework, supports more than $5 billion in assets under the management of more than 30 qualified asset managers. Institutions and private wealth customers may operate with conventional financial protections while accessing digital markets thanks to the custody architecture’s support for the safe segregation of client assets.

More than 2,000 institutions now utilize Bybit’s infrastructure – a 100% year-over-year growth — showing increased demand for hybrid financial platforms that integrate conventional and digital asset ecosystems.

A Unified Financial Infrastructure

Currently serving more than 82 million users in 181 nations and territories, Bybit is backed by:

- Connectivity to nearly 2,000 local banks and 58+ fiat gateways

- Over 200,000 P2P merchants worldwide

- Over 2.7 million Bybit Cards issued globally

- Local fiat payment support in 10+ countries via Bybit Pay

- $7.1 billion in Bybit Earn AUM, generating $110 million in yield for users in 2025

- As of January 29, 2026, Bybit led XAUT (Tether Gold) spot trading worldwide with 16% market share

Bybit TradFi, which began as the world’s first TradFi product from a cryptocurrency exchange in 2022, now incorporates over 200 TradFi instruments. In Q1, it plans to introduce 500 trading pairs, including stocks, CFDs, forex, commodities, and indices, in addition to crypto markets. This will create a single environment where users can manage a variety of financial activities.

Compliance-Driven Global Expansion

Bybit’s platform development is being created in compliance with growing global regulatory frameworks and in conjunction with licensed banking and custodial partners. To satisfy regulators and conventional financial players, institutional onboarding norms, custody architecture, and transaction monitoring systems are being reinforced.

The firm maintains active relationships with more than 10 global banks and custodians, allowing unified collateral systems where fiat, conventional assets, and crypto holdings may coexist safely.

AI as Financial Infrastructure

Throughout Bybit’s operations, artificial intelligence is being implemented as essential infrastructure—not as an add-on feature, but as a system-wide efficiency engine.

AI deployment has already enhanced engineering productivity by 30%. In 2026, Bybit will roll out:

- AI4SE aims to increase software lifecycle efficiency by 50%.

- A network of AI agents across the whole organization that supports analytics, risk management, compliance tracking, and customer assistance.

- TradeGPT, a customized AI assistant that makes financial market access easier, has been upgraded.

This AI platform is intended to reduce operating expenses, enhance risk management, and provide financial services to marginalized communities.

“This transformation is about mainstream finance,” Zhou added. “We are moving beyond niche crypto services to build a new financial platform where crypto becomes a core part of real-world financial activity – empowering users across both traditional and crypto markets to unlock more efficient capital utilization.”