- BlackRock’s BUIDL token, backed by U.S. Treasury securities, reached a $500 million market cap in four months.

- Ondo Finance and Mountain Protocol drive growth using BUIDL for their yield-generating products in DeFi protocols.

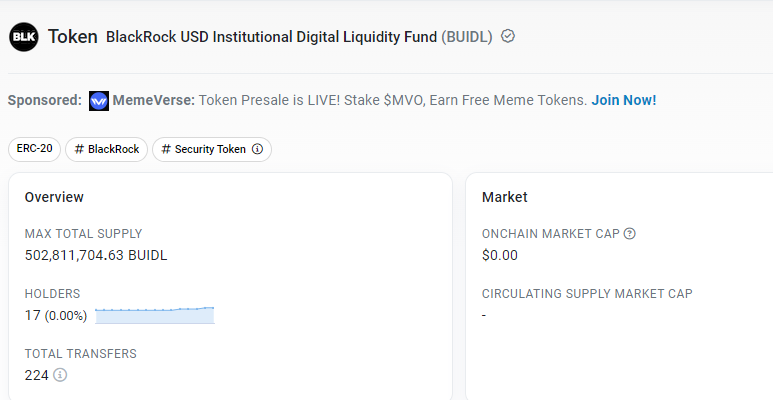

BlackRock’s BUIDL token, created in partnership with Securitize and backed by U.S. Treasuries, has exceeded a market value of $500 million. Ethereum blockchain data from Etherscan confirmed the milestone on Monday.

BUIDL token was introduced in mid-March and rapidly accumulated $502.8 million in tokenized treasuries within four months. This significant growth has been driven by investments from various decentralized finance (DeFi) protocols, including Ondo Finance and Mountain Protocol, which utilize BUIDL as a backing asset for their yield-generating products.

Ondo Finance Boosts BUIDL to $500M with OUSG Backing

Ondo Finance’s recent purchase of additional BUIDL tokens, which back its OUSG token, played a crucial role in pushing BUIDL past the $500 million mark. Ondo’s OUSG currently holds $173.7 million worth of BUIDL. Additionally, Mountain Protocol uses BUIDL to back its yield-bearing stablecoin, USDM.

The BUIDL token stands out in the tokenized treasury landscape, having overtaken Franklin OnChain U.S. Government Money Fund (BENJI) as the largest tokenized treasury fund in late April. It has maintained this top position since then, demonstrating strong and sustained demand from institutional investors.

Further, digital asset brokers such as FalconX and Hidden Road have also added BUIDL to their collateral assets, broadening its appeal among their networks of institutional clients.

BUIDL pledges a 1:1 ratio with the U.S. dollar, offering investors daily accrued dividends through its collaboration with Securitize. The growing interest and trust in tokenized treasury products are evident, with $1.67 billion worth of tokenized treasury funds currently on-chain, according to data from Dune Analytics and 21Shares.

However, the success of BlackRock’s BUIDL highlights the increasing trend of real-world asset tokenization, particularly U.S. Treasuries, as financial institutions and digital asset firms seek to integrate traditional financial instruments into the blockchain ecosystem.