- Bitnomial launches the first-ever CFTC-regulated XRP futures in the U.S.

- Bitnomial voluntarily dismisses its lawsuit against the SEC.

Bitnomial has officially launched XRP US Dollar Myra (XRUY) Futures, marking the first CFTC-regulated XRP futures in the United States. The product applies for physical settlement, ensuring actual XRP is delivered upon contract expiration.

Bitnomial’s new futures contract offers traders a compliant and transparent way to gain exposure to XRP. Unlike cash-settled contracts, physically settled futures enhance price discovery by tying derivatives directly to XRP supply and demand. This structure strengthens market integrity and boosts investor confidence.

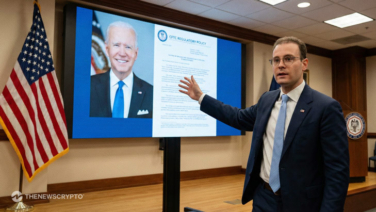

Luke Hoersten, CEO of Bitnomial, emphasized the importance of regulated market infrastructure. He stated that physically settled futures ensure true price discovery and market transparency. Michael Dunn, President of Bitnomial Exchange, highlighted that institutional and retail traders can now access a broader range of CFTC-regulated crypto derivatives.

Bitnomial Withdraws SEC Lawsuit

Alongside the product launch, Bitnomial Exchange, LLC has voluntarily dismissed its lawsuit against the U.S. Securities and Exchange Commission (SEC). The lawsuit, filed in October 2024, challenged whether XRP futures should be classified as security futures contracts. Bitnomial cited evolving SEC policies as a reason for dropping the case, acknowledging improved regulatory clarity for XRP.

This development signals easing regulatory pressure on XRP and the broader crypto market. Ripple CEO Brad Garlinghouse commented on the SEC’s retreat in its case against Ripple. While a cross-appeal remains, he noted that Ripple has moved from being the defendant to the plaintiff.

Over the past two weeks, it has introduced physically settled futures on Solana, Avalanche, Chainlink, Bitcoin Cash, Litecoin, Ethereum, Polkadot, and Hedera. The addition of XRP futures further solidifies its position as a leader in U.S. crypto derivatives trading.

Highlighted Crypto News Today

Bitcoin ETF Inflows Rise as Institutional Interest Returns