- BitMine purchased around 40,000 ETH, worth $83.38 million, from BitGo and FalconX amid a broader ETH price weakness.

- According to the report, BitMine has already secured 3.58% of the ETH supply, completing over 72% of its internal target.

BitMine Immersion Technologies continues to strengthen its Ethereum holdings as part of its broader digital asset strategy, as it bought around 40,000 ETH in the last 12 hours from two separate crypto companies worth around $83.38 million amid Ethereum’s weak market situation.

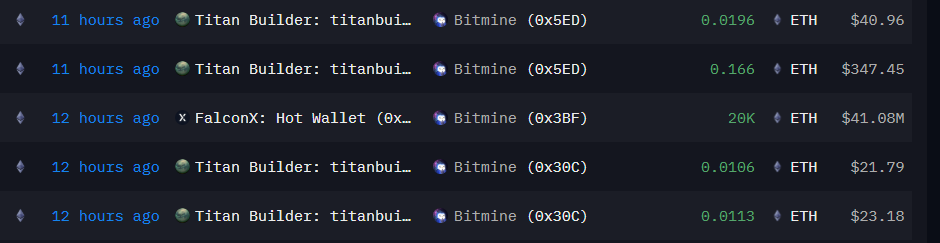

As per the Lookonchain data, BitMine bought 20,000 ETH from BitGo 7 hours ago, according to the time it reported, and it is worth over $42.3 million. Then, before the BitGo transaction, BitMine had bought 20,000 ETH, worth around $41.08 million, from FalconX, which is exactly 12 hours ago as of writing, according to an on-chain analytics platform Arkham.

With that, on February 9, BitMine Technologies released an official report, which mentions, “As of February 8th, the Company’s crypto holdings are comprised of 4,325,738 ETH at $2,125 per ETH,” and mentioned that they acquired 40,613 ETH in the last week.

BitMine has already accumulated 3.58% of Ethereum’s total supply, and in just six months, it has completed over 72% of its internal target known as the Alchemy of 5%, which means a goal to own 5% of all ETH, noted in the report.

Also, Bitmine’s total staked ETH stands at 2,897,459, as of February 8, which represents $6.2 billion at $2,125 per ETH. As the report quoted Lee, “Bitmine has staked more ETH than other entities in the world. At scale, the ETH staking rewards are $374 million annually or greater than $1 million per day.”

BitMine Stays Bullish on ETH Despite Price Weakness

Meanwhile, Ethereum is trading at its monthly lows, down more than 33%, as of writing, it is trading at $2,068, with 0.98% down over the 24 hours, and over 11% for the past week. In spite of this downturn and nearly $7 billion in treasury losses, BitMine continued to accumulate Ethereum as part of its target.

For this, Tom Lee, Executive Chairman of Bitmine, said, “Bitmine has been steadily buying Ethereum, as we view this pullback as attractive, given the strengthening fundamentals. In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance.”

Highlighted Crypto News:

Vitalik Buterin Says ETH-Backed Algorithmic Stablecoins Qualify as ‘True DeFi’