- Dogwifhat surged 15% after its Robinhood listing but lost all gains due to Bitcoin’s sudden price drop to $92K.

- Currently, WIF priced at $3.11, a 12% decline from its intraday high of $3.57.

Earlier today, the largest Solana-based memecoin, dogwifhat (WIF), saw its price climb by over 15.91%, rising from a low of $3.08 to a high of $3.57 following its listing on popular crypto exchange Robinhood.

This surge was triggered by a cryptic post from the exchange on Monday, featuring the iconic wool hat linked with the token. The post created significant excitement among traders, and shortly after, CEO Vlad Tenev confirmed WIF’s official listing on the platform.

However, the excitement was short-lived as the cryptocurrency market experienced a downturn. By the time of writing, dogwifhat had retraced to $3.14, largely due to a global market decline caused by Bitcoin’s sudden plunge below $92.5K.

JUST IN: 🚨 Bitcoin drops back to the $92K zone, leading to a 3.63% decline in the global market cap. ↘️

— TheNewsCrypto (@The_NewsCrypto) November 26, 2024

Currently, $BTC is priced at $92,792! 🔻#Bitcoin #BTC pic.twitter.com/MYEU3aFDdI

This drop has been caused by institutional activity and the looming expiry of Bitcoin and Ethereum derivatives. A total of $9.4 billion in Bitcoin options and $1.3 billion in Ethereum options nearing expiry—traders have been adjusting positions, which may result in significant market volatility.

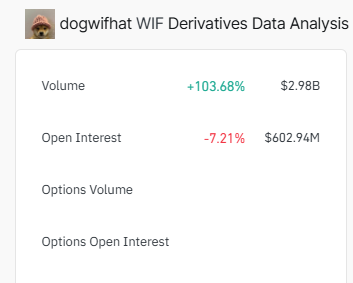

Interestingly, dogwifhat open interest decreased by 7.21%. Although it still maintains a $2.98 billion volume, marking a 103% increase, as per Coinglass data. Despite the retracement, dogwifhat remains above its key support level at $3 with a market cap of $3.15 billion.

However, the speculation is rising that the altcoin could face further declines as traders engage in profit-taking.

Will the Dogwifhat Price Drop Below $3?

On the 4-hour WIF/USDT trading pair, the memecoin shows an RSI of 45, indicating relatively neutral to slightly bearish market sentiment. However, there is no strong indication of an extreme oversold condition. While the RSI suggests a modest downward trend, the negative CMF indicates that there is currently more selling activity than buying.

Zooming in, the 20-day EMA and 50-day SMA are both above the WIF price, suggesting that both short-term and medium-term trends are bearish. The 20-day EMA and 50-day SMA are now acting as resistance. If the price fails to break above these moving averages, downward pressure may continue.

If dogwifhat finds support at this level and bounces back up, it could signal that the correction is over. Also, the asset is ready to continue its bullish trend.

In the event of a downtrend, if the WIF price breaks below the 78.6% Fib level at $2.19, the next significant support could be around the 88.6% Fib level (usually around $2.03). Alternatively, the price may continue to the $2.00 region or lower, depending on overall market conditions.