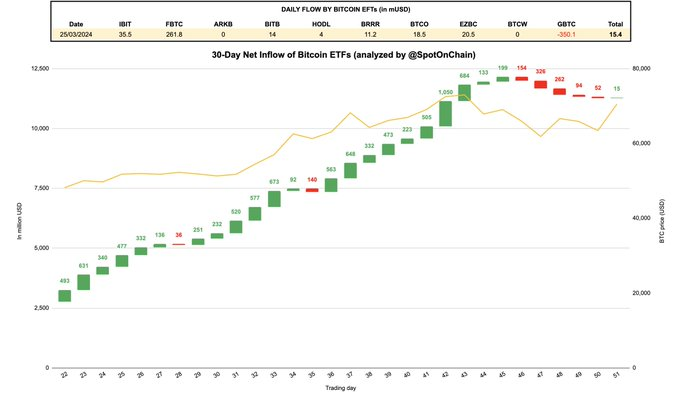

- Bitcoin’s price soared to $71,162 amid the net inflows into ETFs.

- Fidelity’s FBTC Bitcoin ETF attracted significant inflows of $261M, outpacing BlackRock’s IBIT of $35.5M

Bitcoin (BTC) surged past the $71,000 mark, marking a strong start to the week following a brief dip in prices last week. The renewed bullish sentiment has been fueled by increased investor interest, with net inflows into Bitcoin exchange-traded funds (ETFs) again turning positive.

According to Spot on Chain’s report, the total inflow of Bitcoin ETFs stood at $15.4 million as of March 25th. Further, among the nine-spot Bitcoin ETFs, Fidelity’s FBTC Bitcoin ETF stole the spotlight, attracting $261 million in inflows on Monday. This marked a significant increase compared to BlackRock’s IBIT, which saw $35 million in inflows during the same period.

Despite the positive momentum in ETF inflows, Grayscale’s Bitcoin Trust (GBTC) continued to experience significant outflows, totaling $350 million on Monday. Bloomberg strategist James Seyffart suggests recent outflows from Bitcoin investments may be tied to bankruptcy, especially with Gemini and Genesis selling around 68 million shares of $GBTC. Seyffart expects this trend to slow down in the coming week.

Still, if the current trend persists, there is speculation that BlackRock’s and Fidelity’s ETF may surpass Grayscale’s GBTC by mid-April, which may set different trends in the cryptocurrency investment space.

At the time of writing, BTC is trading at $70,368 with a market cap of $1.38 trillion, reflecting a 5.3% increase. Following this positive momentum, high-profile figures like Rich Dad Poor Dad author Robert Kiyosaki have started making Bitcoin price predictions. Kiyosaki now foresees the cryptocurrency reaching $100K by September.