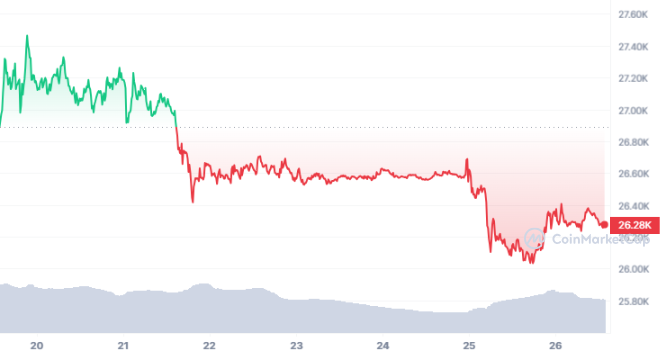

- The price is continuing a downward trend that began when it faced resistance at $27,420.

- A little wave of recovery has pushed prices back over the $26,200 level.

The recent announcement by Citibank to provide blockchain technology for institutional deposits, convertible into “Citibank tokens” for round the clock cross-border transactions, is a major step forward in the evolution of the financial industry.

Robert Kiyosaki, an investor and author, tweeted that Citibank’s recent engagement might mark a turning point for Bitcoin and the USD. On September 18th, Citi stated that its Treasury and Trade Solutions (TTS) division will begin testing out Citi Token Services, a new venture that would use blockchain and smart contract technology.

Struggle Continues

At the time of writing, Bitcoin is trading at $26,273, up 0.42% in the last 24 hours as per data from CMC. Moreover, the trading volume is down 2.88%. The Bitcoin price is continuing a downward trend that began when it faced resistance at $27,420. The price found support at $26,000 level yesterday, after recently breaking the $26,430 support level.

Recently, there has been a little wave of recovery that has pushed prices back over the $26,200 level. If the price manages to break above the $26,700 resistance level then it will likely rally towards the $27,450 mark. Moreover, if the bulls could drive the price above this resistance level then it will likely test the $28,000 mark.

However, there are a number of upcoming resistance levels and shrinking support levels, suggesting that the present price dynamics of Bitcoin are negative. If the price breaks below $26,000 support level then it will be likely heading towards the $25,450 mark. If the cryptocurrency keeps falling, it may possibly test the $25,000 level, marking a new short-term low.