- Bitcoin experienced a decline of over 5%, dropping from $44,034 to $41,649.

- In the past 24 hours, liquidations have surpassed $411 million.

A turbulent start to the week as major cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), faced a bearish trend in intraday trading. BTC saw a significant dip of over 5% in the 24 hours, reaching a low of $41,649 before recovering to $42,510, as per CoinMarketCap data.

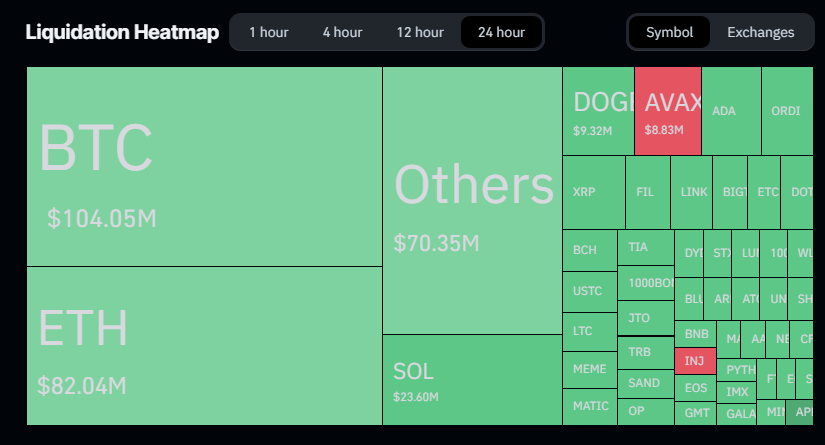

Data from CoinGlass revealed $411 million in liquidations over the past day, with $357 million in long positions across the broader crypto market. The liquidation heatmap displayed that over $104 million BTC and $82 million ETH have been liquidated. Small-cap altcoins also experienced a decline amid the overall market volatility.

Will BTC Regain its Rally?

Despite the downturn, Bitcoin managed to maintain a bullish stance, even breaking the $42,500 resistance. Currently, BTC is trading at $42,182, with a daily trading volume of $24.7 billion, marking a 54% increase in the last 24 hours.

The price of BTC is now in the process of a recovery wave, encountering key resistance around the $42,600 level. If Bitcoin surpasses the $43,000 resistance, it could spark bullish momentum, potentially leading to an ascent towards $43,650. A decisive close above this level might initiate a strong upward movement, targeting the next significant resistance at $43,950, with further potential gains toward $44,500.

However, if Bitcoin fails to breach the $43,000 resistance, there is a possibility for another decline. Immediate support will be formed near the $41,800 level, followed by a $41,350 support zone. A breach below this level could lead to a test of the $40,000 zone, signaling potential downsides for the leading cryptocurrency.