- The SEC Chair will testify before the House Financial Services Committee this week.

- If the price goes below $25,600 support then it will likely test the $25,000 support level.

Bitcoin’s price remains over $26,000 despite recent market volatility. The issue, though, is how long this state of affairs can last. The Ripple party and Gary Gensler’s congressional hearing are two of the major events coming up this week. With the SEC’s judgement on Bitcoin ETFs coming up in October, investors are starting to focus on the latest impending news.

On September 27, 2023, SEC Chair Gary Gensler will testify before the House Financial Services Committee. Moreover, when it comes to crypto rules, this committee has a history of disagreements with Gensler.

In addition, Ripple will throw a party called “The Proper Party” in New York City on September 29, 2023. This party commemorates a partial success in the SEC lawsuit, heralding more clarity in the law. Furthermore, this may affect investor’s sentiment, which might lead to a price increase for XRP.

Bears Continue to Dominate

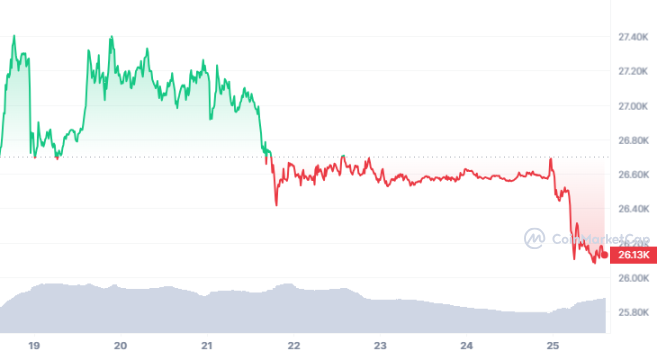

At the time of writing, BTC is trading at $26,130, down 1.70% in the last 24 hours as per data from CMC. However, the trading volume of BTC is up by 68.82%. The price recently broke the key $26,390 support level. If the price goes below $25,600 support then it will likely test the $25,000 support level.

On the other hand, if the bulls drive the price above the $26,390 resistance level, then price is likely to test $27,450 resistance level. The overall market sentiment is bearish with major altcoins trading in red. The key events this week will play a significant role in moving the price in either direction.