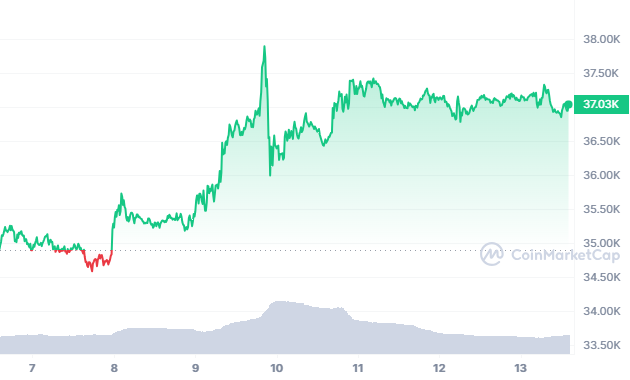

- At the time of writing, Bitcoin is trading at $37,029, down 0.25% in the last 24 hours.

- If the price manages to break above $37,800 mark, then it will likely test $42,600.

This year has seen a three-fold surge in the total number of crypto wallet addresses holding more than $1 million in Bitcoin. BitInfoCharts reports that the number of addresses holding in excess of $1 million dollars in BTC has increased by 237% from January 1 (when there were 23,795) to the present day (when there are 81,925).

Furthermore, on November 9, 2021, one day before Bitcoin hit its ATH of $69k on November 10, 2021, the number of addresses holding in excess of $1 million in Bitcoin reached its ATH, according to information provided by Glassnode.

Eyes on SEC Approval

A possible turning point in the United States SEC’s consideration of spot Bitcoin ETFs has been revealed by Nate Geraci, president of the ETF Store and host of the ETF Prime podcast. According to a post by Geraci on twitter, which cited Bloomberg analyst James Seyffart, the SEC has until Friday, November 17 to issue 19b-4 approval orders for a group of spot Bitcoin ETFs.

Several experts predict the SEC will give consent for numerous Bitcoin ETFs at the same time, with a crucial deadline looming likely by January 2024.

At the time of writing, Bitcoin is trading at $37,029, down 0.25% in the last 24 hours as per data from CoinMarketCap. Moreover, the trading volume is down 1.54%. The price has been consolidating lately after making a failed attempt to climb above the $38,000 level and finding support around $36,000 area.

If the price manages to break above $37,800 mark, then it will likely test the $42,600 resistance level. On the other hand, if price manages to go below $36,210 then it will likely test $35,670 support level.