- High volatility is anticipated this week due to the release of crucial data on U.S CPI and PPI.

- If the BTC price manages to go past the $26,380 mark then a fresh rally is expected.

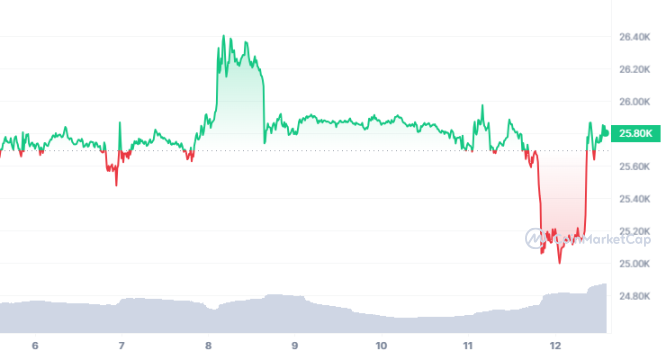

Bitcoin price has so far managed to avoid further decline by finding support around the $25,000 region; it was around this price that the last upswing to $31,500 began. BTC made a dramatic recovery after yesterday’s drop, climbing to around $26,000 earlier today. In a short time, the BTC price rose from $25,210 to $25,973. Furthermore, high volatility is anticipated this week due to the release of U.S CPI and PPI data.

The former CEO of BitMEX, Arthur Hayes, recently made the suggestion that a rate drop by the Fed might boost BTC to the $70,000 level and revitalize the US financial system. This claim adds a new dimension to the discussion among investors regarding the future course of the crypto market.

High Volatility Expected

According to Glassnode, a blockchain data analytics firm, the market for digital assets “continues to dry up.” The digital asset market’s liquidity, volatility, and volume have all been falling, and several metrics have reverted to their pre-bull levels of 2020.

At the time of writing, Bitcoin is trading at $25,800, up 0.03% in the last 24 hours as per data from CMC. Moreover, the volume is up 111.92% in the last 24 hours. If the price manages to go past the $26,380 mark then a fresh rally towards $28,000 is expected.

On the other hand, if the bears pull the price below the $25,000 level then a decline all the way till $20,130 is highly expected. Investors and traders are keenly waiting for the upcoming U.S CPI and PPI data release this week to determine the next move.