- BTC’s price fell below $60,000, settling around $56,500, as US spot Bitcoin ETFs saw outflows exceeding $500M.

- The sell-off intensified after the Fed kept interest rates unchanged in a recent FOMC meeting.

Bitcoin’s (BTC) price took a significant hit, dipping below the $60,000 mark and settling around $57,000 amidst concerns of further decline. The downturn was worsened by substantial outflows from US spot Bitcoin ETFs, exceeding $500 million on May 1st. This sell-off intensified following the Federal Reserve’s (Fed) announcement, led by Chair Jerome Powell, to maintain unchanged interest rates during the recent FOMC meeting, resulting in another 6.5% drop in Bitcoin’s value to $56,555.

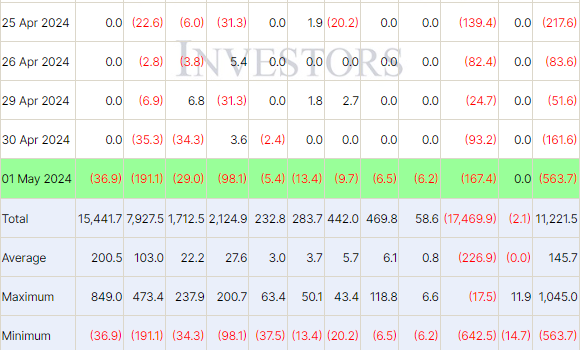

According to data from Farside investors, the market witnessed a staggering net outflow of $563.7 million from spot Bitcoin ETFs on Wednesday. BlackRock Bitcoin ETF IBIT experienced its first outflow since its inception, totaling $37 million. Meanwhile, Fidelity’s FBTC displayed the highest outflows at $191 million, surpassing Grayscale’s GBTC at $167 million. Remarkably, all nine spot Bitcoin ETFs in the U.S. reported net outflows on the same day, marking a significant shift in investor sentiment.

Will Bitcoin (BTC) Continue to Decline?

At the time of writing, Bitcoin is trading at $57,446, reflecting a 4.54% decrease in the past 24 hours and a 10% decline over the week. Furthermore, it has retreated by 22% from its all-time high of $73,750.

The Bitcoin market alarms continued selling pressure, with Bitcoin breaching key support levels recently. Now, the next critical support level lies around $53,500. However, a failure to hold this level could precipitate a further decline, with Bitcoin possibly dropping below $50,000 and even reaching $46,000.

Despite the bearish outlook, there are indications of a bullish trend line forming, with resistance at $59,000. A breakthrough above the $61,000 resistance barrier could propel the price upward, with the next resistance level at $63,500. If the price crosses this hurdle, it may rally towards $65,000, offering a glimmer of hope amidst the current market turbulence.