- Bitcoin ETFs saw a $165M inflow, marking five straight days of gains.

- The Fed’s decision to hold rates triggered a 1,300% surge in ETF inflows.

- Analysts remain split on Bitcoin’s short-term trend amid key resistance levels.

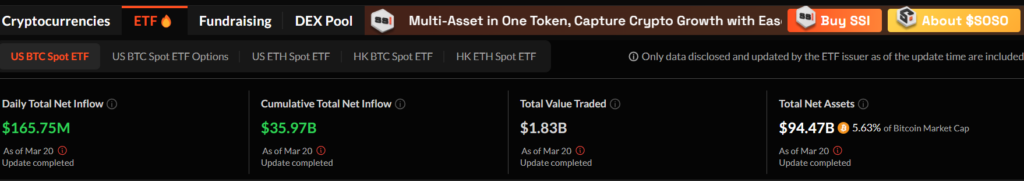

Bitcoin exchange-traded funds (ETFs) saw a return of inflows, posting $165 million on Thursday according to SoSoValue data. This is the fifth day in a row that ETFs have seen inflows, marking increased institutional demand after weeks of outflows.

Institutional Interest Surges

Following a loss of more than $6 billion in outflows, Bitcoin ETFs are now experiencing a turnaround. BlackRock’s iShares Bitcoin Trust ETF (IBIT) topped with $172 million in new investments.

Followed by Fidelity Wise Origin Bitcoin Fund (FBTC) and Grayscale Bitcoin Trust ETF (GBTC) with $9.19 million and $5.22 million, respectively. Bitwise Bitcoin ETF (BITB), however, experienced $17.4 million in outflows, and Grayscale’s GBTC lost almost $8 million.

Fed’s Interest Rate

One of the key factors behind this revival was the Federal Reserve’s choice to keep interest rates unchanged. On March 20, spot Bitcoin ETFs experienced a 1,300% increase in inflows, amounting to almost $166 million. Bitcoin ETFs accumulated almost $700 million in five days.

The Fed, which suggested rate cuts in the future, spurred risk-on assets’ optimism. Bitcoin momentarily jumped 4.5% to $87,431 before falling back. Ethereum and Solana also gained, while the overall crypto market cap rose to $2.947 trillion.

Even with bullish ETF inflows, analysts are split on the short-term direction of Bitcoin. Technical analysis places Bitcoin at crucial resistance, challenging a falling trendline and the 100-day moving average.

Analyst’s view

Crypto analyst RJT_WAGMI indicated a potential breakout might spark a rally, while rejection can induce a dip. Trader Great Mattsby mentioned that Bitcoin is still in a long-term trend channel, and the next major high is due in 2025-26.

CryptoQuant CEO Ki Young Ju cautioned that although ETF demand is high, on-chain metrics indicate slowing bull cycle, with Bitcoin potentially taking 6-12 months to cross its all-time high.

Inflows for Bitcoin ETFs indicate renewed institutional optimism, spurred by the Fed’s move and clarity in regulation. Nevertheless, macroeconomic forces and technical resistance will dictate the path of Bitcoin, with both short-term volatility and long-term appreciation.